In our increasingly digital world, the way we handle money is evolving rapidly. Traditional cash and checks are being supplemented, and in many cases replaced, by digital payment methods. E Money apps are at the forefront of this transformation, offering a plethora of benefits that make managing finances easier, more secure, and more efficient. Here’s why you might want to consider adopting an E Money app for your financial needs.

1. Convenience and Accessibility

One of the primary advantages of E Money apps is their convenience. With just a few taps on your smartphone, you can make transactions, check your balance, and transfer money. This ease of use is particularly valuable in today’s fast-paced world, where time is often of the essence. Whether you’re paying bills, splitting dinner with friends, or shopping online, E Money apps streamline the process, eliminating the need to carry physical cash or visit a bank.

2. Enhanced Security

E Money apps offer robust security features that protect your financial information. Many apps use encryption technology to safeguard data, making it difficult for unauthorized users to access your account. Additionally, biometric authentication, such as fingerprint or facial recognition, adds an extra layer of security, ensuring that only you can access your funds. In case of a lost or stolen device, most apps provide the option to lock your account remotely, minimizing the risk of fraud.

3. Instant Transactions

Unlike traditional banking methods, which can take several days for transactions to process, E Money apps provide instant or near-instant transactions. This immediacy is especially useful for urgent payments or transfers. Whether you're sending money to a friend, paying for an online purchase, or managing your business transactions, the speed of digital payments can significantly enhance your financial management.

4. Cost Efficiency

Many E Money apps offer low or no fees for transactions, making them a cost-effective alternative to traditional banking methods. For example, international transfers through E Money apps are often cheaper compared to traditional wire transfers. Additionally, some apps provide rewards, cashback offers, or discounts for using their services, further enhancing their cost-efficiency.

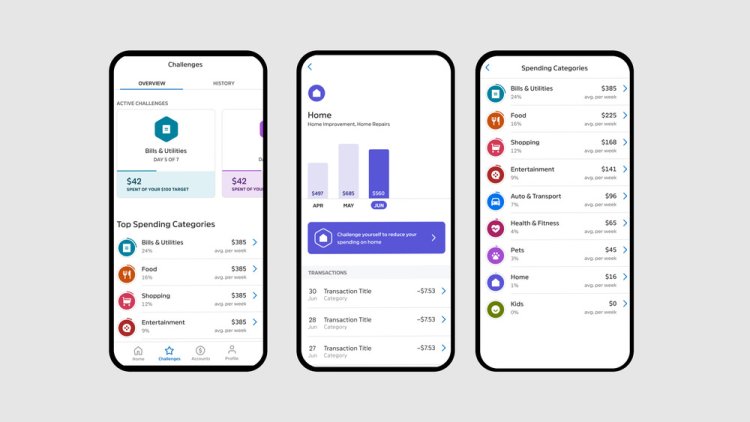

5. Budgeting and Expense Tracking

E Money apps often come with built-in budgeting tools and expense tracking features. These tools help you monitor your spending, set financial goals, and analyze your spending patterns. By having a clear view of your finances, you can make more informed decisions and better manage your budget. This feature is particularly useful for individuals looking to gain control over their financial habits and achieve their financial goals.

6. Integration with Other Financial Services

Many E Money apps integrate seamlessly with other financial services, such as investment platforms, savings accounts, and financial planning tools. This integration allows for a holistic view of your financial landscape, making it easier to manage and optimize your investments, savings, and spending. Additionally, some apps offer features like bill payment scheduling, which can help ensure that you never miss a payment.

7. Environmental Impact

By reducing the reliance on physical cash and paper checks, E Money apps contribute to a more environmentally friendly financial system. Digital payments help minimize the need for paper, reducing waste and the carbon footprint associated with traditional banking practices. For environmentally conscious individuals, this can be an additional incentive to adopt digital payment methods.

8. Global Reach

E Money apps often support international transactions, allowing you to send and receive money from anywhere in the world. This global reach is beneficial for individuals who travel frequently, expatriates, or businesses with international clients. The ability to manage and transfer money across borders with ease makes E Money apps an essential tool in the global economy.

Conclusion

E Money apps represent a significant advancement in how we handle our finances. With their convenience, security, cost-efficiency, and additional features, they offer numerous advantages over traditional payment methods. Whether you’re looking to streamline your financial management, enhance security, or simply enjoy the ease of digital transactions, adopting an E Money app can be a smart move in today’s digital age. As technology continues to evolve, these apps will likely become even more integral to our daily lives, making now the perfect time to embrace the future of digital payments.