Navigating the Future: Global Electronic Bill Presentment and Payment Market Insights

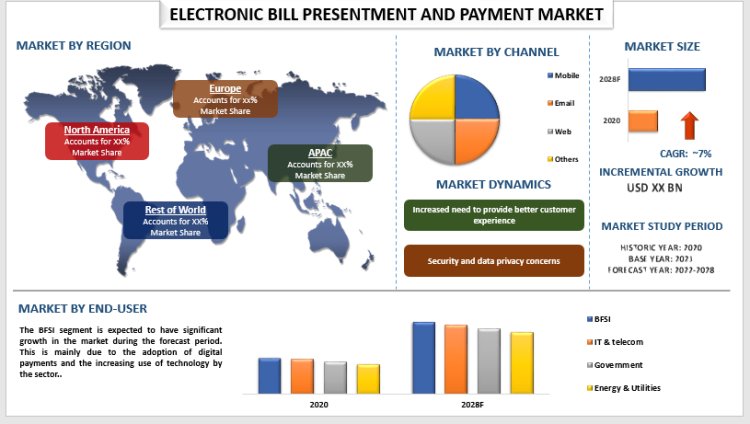

The global landscape of Electronic Bill Presentment and Payment (EBPP) is undergoing a transformative surge, with an anticipated growth rate of approximately 7% during the forecast period.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

The global landscape of Electronic Bill Presentment and Payment (EBPP) is undergoing a transformative surge, with an anticipated growth rate of approximately 7% during the forecast period. EBPP, a revolutionary process empowering billers to create and present invoices online, is becoming the cornerstone of seamless transactions in the digital era. This growth is propelled by the extensive use of EBPP services in bill payments, fund transfers, and mobile & DTH recharge. As the world embraces e-commerce and experiences robust logistics and digital infrastructure, the EBPP market is poised for unprecedented expansion.

Access Sample PDF Here- https://univdatos.com/get-a-free-sample-form-php/?product_id=28267

Driving Forces Behind EBPP Market Surge

1. Rising Tide of E-Commerce

The growth of the EBPP market finds roots in the escalating adoption of e-commerce globally. The convenience and accessibility of online shopping have led to a substantial increase in the number of people making purchases online. A noteworthy statistic highlights that almost 96% of Americans have engaged in at least one online purchase in their lifetime. This surge in online transactions directly contributes to the growth of the EBPP market.

2. Digital Infrastructure Catalyst

A robust digital infrastructure plays a pivotal role in the growth of EBPP. The seamless integration of various technologies, such as Artificial Intelligence (AI) and Machine Learning (ML), enhances the efficiency and reliability of electronic bill presentment and payment services. As financial services and banks embrace these technologies, they contribute significantly to the expanding consumer base and the growth of the Banking, Financial Services, and Insurance (BFSI) sector.

Market Dynamics Unveiled

1. Channel Dynamics: Mobile Takes the Lead

In the intricate segmentation based on channels, mobile emerges as the frontrunner, witnessing a higher Compound Annual Growth Rate (CAGR) during the forecast period. The introduction of diverse wallet applications provides users with a more convenient, fast, and reliable platform for transactions. The integration of banking systems with mobile technology further propels the mobile segment's growth in the EBPP market.

2. End-User Landscape: BFSI Steers the Ship

The end-user landscape is dominated by the BFSI sector, holding a significant share in the EBPP market. The burgeoning banking industry, fueled by the surge in online transactions, is a key factor driving the growth of the BFSI segment. Additionally, the adoption of digital payments and the incorporation of advanced technologies like AI and ML contribute to the sector's expanding consumer base.

3. Global Presence: APAC Takes Center Stage

For a comprehensive understanding of market adoption, a global analysis considers regions such as North America, Europe, Asia-Pacific (APAC), and the Rest of the World. In 2020, APAC emerged as a significant player in the global EBPP market. The region's higher investments in the IT and financial sectors, coupled with the increasing prevalence of online transactions, underscore its importance. For instance, in India, the Unified Payments Interface (UPI) recorded over 30 billion transactions worth USD 190 billion in 2022, marking a substantial milestone in the region's digital payment landscape.

For Detailed Analysis on the Report- https://univdatos.com/report/electronic-bill-presentment-and-payment-market

Key Players Steering the EBPP Revolution

In this dynamic landscape, key industry players are at the forefront, shaping the trajectory of EBPP. Companies such as ACI Worldwide Inc., Bottomline Technologies Inc., Communications Data Group Inc., CSG Systems International Inc., CyberSource Corporation, ebpSource Limited, eBillingHub, Enterprise jBilling Software Ltd., Fiserv Inc., and FIS are instrumental. These market leaders engage in strategic mergers and acquisitions, along with partnerships, to deliver cutting-edge products and technologies, ensuring customers benefit from the latest advancements in the EBPP arena.

In conclusion, the Global Electronic Bill Presentment and Payment Market stands on the precipice of unparalleled growth, driven by the global surge in e-commerce, advancements in digital infrastructure, and the pivotal role played by mobile channels and the BFSI sector. As the world navigates the future of seamless transactions, the EBPP market continues to be a transformative force, reshaping the landscape of online financial interactions.