PharmEasy Unlisted Share Price Analysis: Current Trends and Future Projections

In the dynamic landscape of healthcare and e-commerce, PharmEasy has emerged as a significant player, revolutionizing the way we access medicines and healthcare services. As an unlisted company, PharmEasy’s share price remains a topic of interest for investors, analysts, and industry enthusiasts. In this article, we delve into the current trends surrounding PharmEasy’s unlisted share price and explore potential future projections. Understanding Unlisted Shares Before we dive into PharmEasy’s specifics, let’s briefly understand what unlisted shares are. Unlike publicly traded companies listed on stock exchanges, unlisted shares belong to companies that haven’t undergone an initial public offering (IPO). These shares are not actively traded on stock markets, making them less accessible to the general public. PharmEasy’s Journey PharmEasy, founded in 2015, disrupted the traditional pharmacy model by providing an online platform for ordering medicines and healthcare products. Its user-friendly app, efficient delivery system, and focus on affordability quickly gained traction among consumers. The company expanded its services to diagnostics, teleconsultations, and wellness products, further solidifying its position in the market. Current Trends in PharmEasy’s Unlisted Share Price Growth Trajectory: PharmEasy’s unlisted share price has witnessed significant growth over the past few years. Factors contributing to this growth include increased user adoption, strategic acquisitions, and expansion into new geographies. Market Sentiment: Positive sentiment around digital health platforms has boosted investor confidence. The COVID-19 pandemic accelerated the adoption of online healthcare services, benefiting companies like PharmEasy. Regulatory Landscape: Unlisted shares are influenced by regulatory changes and government policies. Investors closely monitor developments related to e-pharmacies and healthcare regulations. Future Projections Consolidation and Competition: As the healthcare sector evolves, PharmEasy faces competition from other players. Future share price movements will depend on its ability to stay ahead in a competitive market. Monetization Strategies: PharmEasy’s revenue model includes commissions from pharmacies and diagnostic centers. Investors will watch how the company diversifies its revenue streams and achieves profitability. Potential IPO: Speculation about PharmEasy’s IPO remains high. If it goes public, the share price dynamics will change significantly. Investors anticipate an IPO as an opportunity to participate in the company’s growth story. Check Prices of Our Other Unlisted Shares Bira Share Price NSE Unlisted Share Price Polymatech Share Price Sterlite Power Tranmission Share price OYO Unlisted Share Price Orbis Unlisted Share Price Conclusion PharmEasy unlisted share price reflects its journey from a startup to a major player in the healthcare ecosystem. As the company continues to innovate, expand, and adapt to market dynamics, its share price will remain closely watched. Whether you’re an investor or simply curious about the industry, keep an eye on PharmEasy—it’s a fascinating chapter in India’s healthcare transformation. Remember, investing in unlisted shares involves risk, and thorough research and consultation with financial advisors are essential. As PharmEasy navigates its path, let’s stay informed and see where this healthcare disruptor takes us next!

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

In the dynamic landscape of healthcare and e-commerce, PharmEasy has emerged as a significant player, revolutionizing the way we access medicines and healthcare services. As an unlisted company, PharmEasy’s share price remains a topic of interest for investors, analysts, and industry enthusiasts. In this article, we delve into the current trends surrounding PharmEasy’s unlisted share price and explore potential future projections.

Understanding Unlisted Shares

Before we dive into PharmEasy’s specifics, let’s briefly understand what unlisted shares are. Unlike publicly traded companies listed on stock exchanges, unlisted shares belong to companies that haven’t undergone an initial public offering (IPO). These shares are not actively traded on stock markets, making them less accessible to the general public.

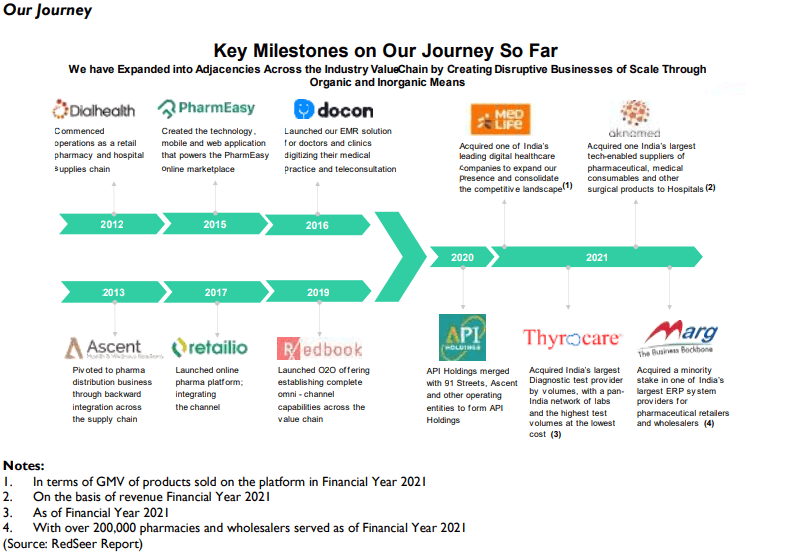

PharmEasy’s Journey

PharmEasy, founded in 2015, disrupted the traditional pharmacy model by providing an online platform for ordering medicines and healthcare products. Its user-friendly app, efficient delivery system, and focus on affordability quickly gained traction among consumers. The company expanded its services to diagnostics, teleconsultations, and wellness products, further solidifying its position in the market.

Current Trends in PharmEasy’s Unlisted Share Price

-

Growth Trajectory:

-

PharmEasy’s unlisted share price has witnessed significant growth over the past few years.

-

Factors contributing to this growth include increased user adoption, strategic acquisitions, and expansion into new geographies.

-

Market Sentiment:

-

Positive sentiment around digital health platforms has boosted investor confidence.

-

The COVID-19 pandemic accelerated the adoption of online healthcare services, benefiting companies like PharmEasy.

-

Regulatory Landscape:

-

Unlisted shares are influenced by regulatory changes and government policies.

-

Investors closely monitor developments related to e-pharmacies and healthcare regulations.

Future Projections

-

Consolidation and Competition:

-

As the healthcare sector evolves, PharmEasy faces competition from other players.

-

Future share price movements will depend on its ability to stay ahead in a competitive market.

-

Monetization Strategies:

-

PharmEasy’s revenue model includes commissions from pharmacies and diagnostic centers.

-

Investors will watch how the company diversifies its revenue streams and achieves profitability.

-

Potential IPO:

-

Speculation about PharmEasy’s IPO remains high. If it goes public, the share price dynamics will change significantly.

-

Investors anticipate an IPO as an opportunity to participate in the company’s growth story.

Check Prices of Our Other Unlisted Shares

Sterlite Power Tranmission Share price

Conclusion

PharmEasy unlisted share price reflects its journey from a startup to a major player in the healthcare ecosystem. As the company continues to innovate, expand, and adapt to market dynamics, its share price will remain closely watched. Whether you’re an investor or simply curious about the industry, keep an eye on PharmEasy—it’s a fascinating chapter in India’s healthcare transformation.

Remember, investing in unlisted shares involves risk, and thorough research and consultation with financial advisors are essential. As PharmEasy navigates its path, let’s stay informed and see where this healthcare disruptor takes us next!