Personal Financial Planning

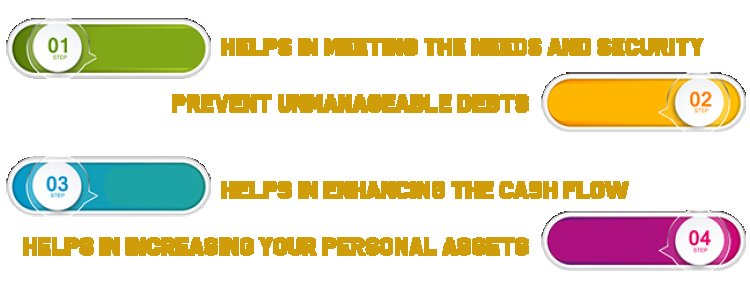

Personal financial planning is a critical component of financial wellbeing. It involves making decisions and taking actions that will help you to achieve your financial goals. These goals may include building wealth, saving for retirement, buying a home, or paying off debt.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Personal financial planning is a critical component of financial wellbeing. It involves making decisions and taking actions that will help you to achieve your financial goals. These goals may include building wealth, saving for retirement, buying a home, or paying off debt.

Many people are intimidated by the idea of personal financial planning, but it doesn't have to be complicated or overwhelming. With the right tools and resources, anyone can create a personalized financial plan that can help them reach their goals.

The first step in financial planning is to assess your current financial situation. This includes understanding your income, expenses, investments, debt, and other financial obligations. Understanding your current financial situation will help you to develop a plan to achieve your financial goals.

Next, you should set financial goals. These goals may include paying off debt, saving for a down payment on a house, investing for retirement, or building wealth. When setting goals, it's important to be realistic and to break down long-term goals into smaller, achievable steps.

Once you have set goals, you should create a budget that will help you to achieve them. A budget should include all of your income and expenses, including bills, groceries, and other necessary expenses. A budget should also include saving for emergencies and goals.