How Market Conditions Impact Plant and Machinery Valuation

Understanding the valuation of plant and machinery is crucial for businesses to make informed decisions about asset management, financial planning, and investment. One of the significant factors influencing plant and machinery valuation is the prevailing market conditions. This article delves into how various market dynamics impact the valuation process, providing valuable insights for businesses and investors.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Understanding the valuation of plant and machinery is crucial for businesses to make informed decisions about asset management, financial planning, and investment. One of the significant factors influencing plant and machinery valuation is the prevailing market conditions. This article delves into how various market dynamics impact the valuation process, providing valuable insights for businesses and investors.

Key Market Conditions Affecting Plant and Machinery Valuation

-

Economic Cycles

- Economic cycles, including periods of growth (expansion) and recession (contraction), directly affect plant and machinery values. During economic growth, demand for industrial equipment often rises, leading to higher business valuations. Conversely, during a recession, reduced industrial activity can lead to lower demand and valuations.

-

Supply and Demand Dynamics

- The balance of supply and demand in the market significantly impacts plant and machinery valuation. When there is a high demand for specific machinery types, but supply is limited, valuations tend to increase. Conversely, an oversupply of machinery with stagnant demand can depress values.

-

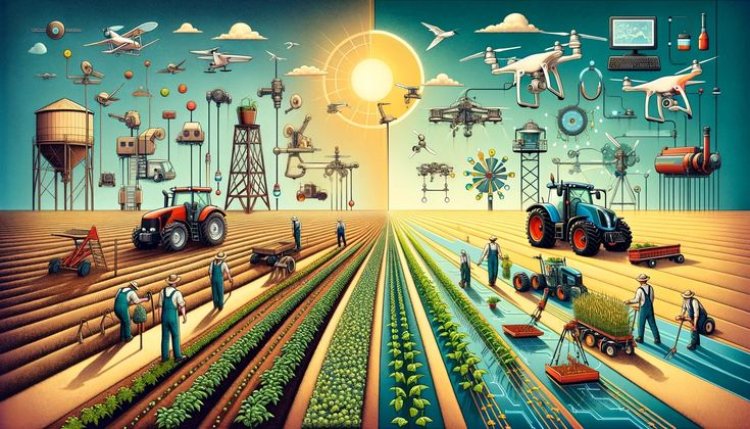

Technological Advancements

- Rapid advancements in technology can render existing machinery obsolete, thereby reducing their market value. Conversely, new technology that increases efficiency and productivity can boost the value of machinery that incorporates these innovations.

-

Regulatory Environment

- Changes in regulations and compliance requirements can affect plant and machinery valuation. For instance, stricter environmental regulations may necessitate upgrades or replacements of older, non-compliant machinery, impacting their market value.

-

Inflation and Interest Rates

- Inflation and interest rates play a crucial role in determining the cost of capital and financing options for purchasing machinery. High inflation or interest rates can increase the cost of capital, affecting the affordability and, consequently, the demand and valuation of machinery.

-

Global Trade Policies

- International trade policies, tariffs, and import/export regulations can influence the cost and availability of machinery. Favorable trade policies may enhance access to affordable machinery, while restrictive policies can lead to higher costs and altered valuations.

Detailed Impact of Market Conditions

Economic Cycles and Valuation

Economic cycles profoundly influence plant and machinery valuation. During periods of economic expansion, businesses invest more in capital assets to expand operations, leading to increased demand and higher valuations for machinery. For example, in a booming construction industry, the demand for heavy equipment like excavators and cranes increases, driving up their market value.

Conversely, during economic downturns, businesses often cut back on capital expenditures, reducing the demand for new and used machinery. This decreased demand can result in lower valuations. Additionally, businesses may liquidate assets to improve cash flow during recessions, increasing the supply of machinery in the market and further depressing prices.

Technological Advancements and Market Dynamics

Technological advancements significantly impact plant and machinery valuation by influencing both the supply and demand sides of the market. As new technologies emerge, machinery that incorporates these advancements can perform more efficiently, offering higher productivity and lower operational costs. This makes such machinery more desirable, increasing its valuation.

However, older machinery that lacks these technological improvements may see a decrease in value as it becomes less competitive. For instance, the shift towards automation and smart manufacturing has increased the value of machinery equipped with IoT (Internet of Things) capabilities while depreciating older, manual equipment.

Regulatory Changes and Compliance Costs

The regulatory environment can affect machinery valuation by imposing new compliance requirements. For instance, new environmental regulations may require businesses to upgrade or replace older machinery to meet emission standards. Machinery that meets these standards will likely see an increase in value due to its compliance and efficiency, while non-compliant machinery may suffer depreciation.

Additionally, health and safety regulations can impact valuations. Machinery that adheres to the latest safety standards is more valuable as it reduces the risk of workplace accidents and associated costs.

Inflation, Interest Rates, and Financing

Inflation and interest rates directly influence the cost of financing plant and machinery acquisitions. Higher inflation can increase the costs of raw materials and manufacturing, leading to higher prices for new machinery. This, in turn, can raise the market value of existing machinery, as replacement costs are higher.

Interest rates affect the cost of borrowing capital for machinery purchases. When interest rates are low, borrowing is cheaper, potentially increasing demand for machinery and boosting valuations. Conversely, high interest rates can deter investment in new machinery, reducing demand and valuations.

Global Trade Policies and Market Access

Global trade policies and tariffs can significantly impact the valuation of plant and machinery. Favorable trade agreements and low tariffs can make imported machinery more affordable, increasing competition and influencing valuations. Conversely, high tariffs and restrictive trade policies can increase the cost of machinery imports, affecting market dynamics and valuations.

For example, the imposition of tariffs on steel and aluminum can increase the cost of manufacturing machinery, leading to higher prices for new equipment and potentially higher valuations for existing machinery.

Conclusion

Market conditions play a critical role in plant and machinery valuation. Understanding the impact of economic cycles, technological advancements, regulatory changes, inflation, interest rates, and global trade policies is essential for accurate valuation. By staying informed about these factors, businesses can make strategic decisions about asset management, investment, and financial planning, ensuring they maximize the value of their plant and machinery assets.

For more insights and professional assistance with plant and machinery valuation, contact our experts today. We provide comprehensive valuation services tailored to your business needs.