Wireless and Mobile Backhaul Equipment Market Size, Drivers, Stategeies 2033

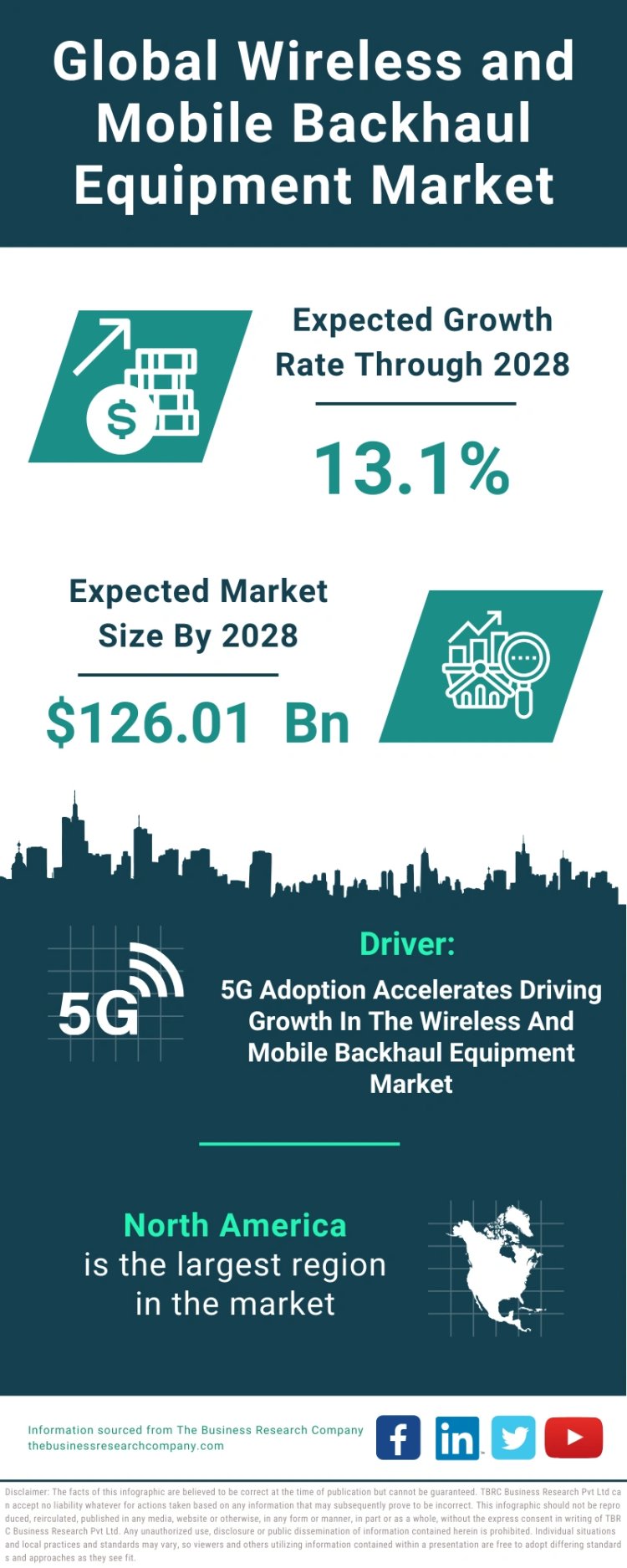

Global wireless and mobile backhaul equipment market size is expected to reach $126.01 Bn by 2028 at a rate of 13.1%, segmented as by equipment, microwave equipment, sub-6 ghz equipment, millimeter equipment, test and measurement equipment

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Wireless And Mobile Backhaul Equipment Market Definition And Segments

Wireless and mobile backhaul equipment refers to various components used in the formation of wireless communication infrastructure to transport data between the internet and subnetworks.

The main equipment in wireless and mobile backhaul equipment are microwave equipment, sub-6 GHz equipment, millimeter equipment, and test and measurement equipment. The topology is point-to-point (PTP) configurations, point to multipoint (PTM) configurations. The various services used are network services, professional services, and system integration services. The applications are building-to-building connectivity, cellular backhaul, broadband connectivity backhaul, video surveillance backhaul and others.

The wireless and mobile backhaul equipment market covered in this report is segmented –

1) By Equipment: Microwave Equipment, Sub-6 Ghz Equipment, Millimeter Equipment, Test And Measurement Equipment

2) By Topology: Point To Point (PTP) Configurations, Point To Multipoint (PTM) Configurations

3) By Services: Network Services, Professional Services, System Integration Services

4) By Applications: Building-To-Building Connectivity, Cellular Backhaul, Broadband Connectivity Backhaul, Video Surveillance Backhaul, Other Applications

The wireless and mobile backhaul equipment market size has grown rapidly in recent years. It will grow from $69.03 billion in 2023 to $77.15 billion in 2024 at a compound annual growth rate (CAGR) of 11.8%. The growth in the historic period can be attributed to increased bandwidth demands, regulatory factors, fiber-based backhaul adoption, evolution to lTE networks, demand for low latency.

The wireless and mobile backhaul equipment market size is expected to see rapid growth in the next few years. It will grow to $126.01 billion in 2028 at a compound annual growth rate (CAGR) of 13.1%. The growth in the forecast period can be attributed to small cell proliferation, optimization of wireless spectrum, market penetration in emerging regions, security enhancement, support for remote workforce. Major trends in the forecast period include 5g network expansion, increased mobile data traffic, advancements in fiber-based backhaul, edge computing requirements, cloud services demand.

5G Adoption Accelerates Driving Growth In The Wireless And Mobile Backhaul Equipment Market

The increasing adoption rate of 5G networks is expected to propel the growth of the wireless and mobile backhaul equipment market going forward. 5G refers to the fifth generation of wireless technology for broadband cellular networks with high speed and reduced latency. Increasing adoption of 5G networks is growing mobile data traffic and generating a large volume of data, thereby creating demand for fast and reliable connectivity. This demand is creating a prospect for mobile, and wireless backhaul vendors to enhance their offerings. For instance, according to a Sweden-based telecommunications company, Ericsson’s latest Mobility Report, in 2022, the number of global 5G subscriptions is expected to surpass the one-billion mark. Therefore, the increasing adoption rate of 5G networks is driving the growth of the wireless and mobile backhaul equipment market.

Increasing Adoption Of IOT Fuels Growth Of Wireless And Mobile Backhaul Equipment Market

The increasing adoption of the Internet of Things (IoT) is expected to propel the growth of the wireless and mobile backhaul equipment market going forward. The Internet of Things (IoT) is a network of physical objects that are embedded with sensors, software, and other technologies to connect and exchange data with other devices and systems over the Internet. Wireless and mobile backhaul equipment serves a crucial role in IoT devices by providing the necessary connectivity infrastructure, enabling seamless communication between IoT devices, and facilitating the transfer of data to and from the cloud. For instance, in September 2022, according to a report published by Ericsson, a Sweden-based telecommunications company, the global IoT connections reached 13.2 billion connections in 2022 and are expected to increase by 18% to 34.7 billion connections by 2028. Therefore, the increasing adoption of the Internet of Things (IoT) drives the wireless and mobile backhaul equipment market.

Major companies operating in the wireless and mobile backhaul equipment market report are Cisco Systems Inc., Nokia Corporation, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co. Ltd., ZTE Corporation, ADC Telecommunications Inc., Alvarion Technologies, ANDA Networks Inc., Celtro Communication Ltd., Alcatel–Lucent SA, Fujitsu Limited, BridgeWave Communications Inc., ECI Telecom Ltd., MRV Communications Inc., SkyFiber Networks, Telco Systems, OneAccess Networks SA, Omnitron Systems Technology Inc., NEC Corporation, Aviat Networks Inc., Siae Microelettronica SPA, Proxim Wireless Corporation, Intracom Telecom SA, Redline Services LLC, CommScope Holding Company Inc., Juniper Networks Inc., DragonWave-X Inc., Radwin Ltd., Siklu Communication Ltd., Tarana Wireless Inc., Cambium Networks Ltd., Ceragon Networks Ltd., Fastback Networks Inc., Blu Wireless Technology Ltd., E-Band Communications LLC, LightPointe Communications Inc., Anova Technologies Co. Ltd., AOptix Technologies Inc.

Advancements In Wireless And Mobile Backhaul Equipment With A Focus On Gigabit Technology And Smart City Applications

Technological advancement is the key trend gaining popularity in the wireless and mobile backhaul equipment market. Major companies operating in the market are developing new technologies such as the MultiHaul TG series of products that uses point-to-point (PtP) connectivity for physical security and smart city applications that works on gigabit wireless technology. For instance, in March 2022, Siklu, an Israel -based gigabit wireless backhaul solutions company introduced the MultiHaul TG series of products that offer multi-gigabit capacity, immunity to interference, and a large spectrum for easy deployment of solutions with mesh topology for physical security and smart city applications. The MultiHaul TG family of products combines L2 SDN mesh.

5.5G Platforms To Revolutionize Wireless And Mobile Backhaul Equipment Market

Major companies operating in the wireless and mobile backhaul equipment market are increasing their focus on introducing innovative platforms such as 5.5G to gain a competitive edge in the market. 5.5G is the industry's first full-series solution that uses distributed massive MIMO technology. This technology provides a single-user experience of 10 Gbps and multi-user capabilities of 10 Gbps, making it a game-changer. For instance, in October 2023, Huawei Technologies Co., Ltd., a China-based technology corporation, launched the industry's first full-series solution for 5.5G. These solutions aim to support new experiences, connections, and services. Huawei's 5.5G solutions are designed to enable ultra-high energy efficiency, spectrum utilization, and O&M efficiency and are based on continuous innovations across five categories of basic capabilities, such as broadband, multi-band, multi-antenna, intelligent, and green.