USA ACCOUNTING & TAX PREPARATION UPWORK UNITED STATES

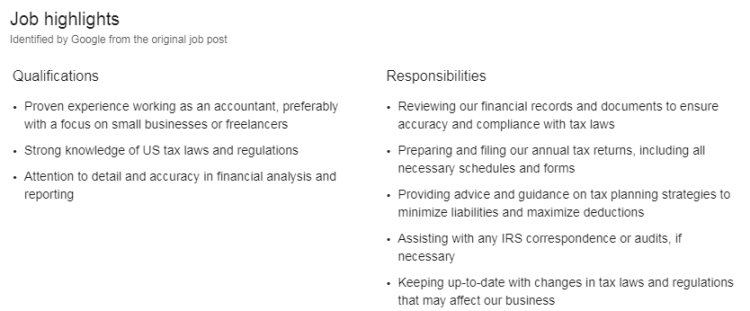

Job highlights Identified by Google from the original job post Qualifications•Proven experience working as an accountant, preferably with a focus on small businesses or freelancers•Strong knowledge of US tax laws and regulations•Attention to detail and accuracy in financial analysis and reporting Responsibilities•Reviewing our financial records and documents to ensure accuracy and compliance with tax laws•Preparing and filing our annual tax returns, including all necessary schedules and forms•Providing advice and guidance on tax planning strategies to minimize liabilities and maximize deductions•Assisting with any IRS correspondence or audits, if necessary•Keeping up-to-date with changes in tax laws and regulations that may affect our business

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Job highlights

Identified by Google from the original job post

| Qualifications•Proven experience working as an accountant, preferably with a focus on small businesses or freelancers•Strong knowledge of US tax laws and regulations•Attention to detail and accuracy in financial analysis and reporting | Responsibilities•Reviewing our financial records and documents to ensure accuracy and compliance with tax laws•Preparing and filing our annual tax returns, including all necessary schedules and forms•Providing advice and guidance on tax planning strategies to minimize liabilities and maximize deductions•Assisting with any IRS correspondence or audits, if necessary•Keeping up-to-date with changes in tax laws and regulations that may affect our business |