Unleashing the Power of fintech application: Transforming the Financial Landscape

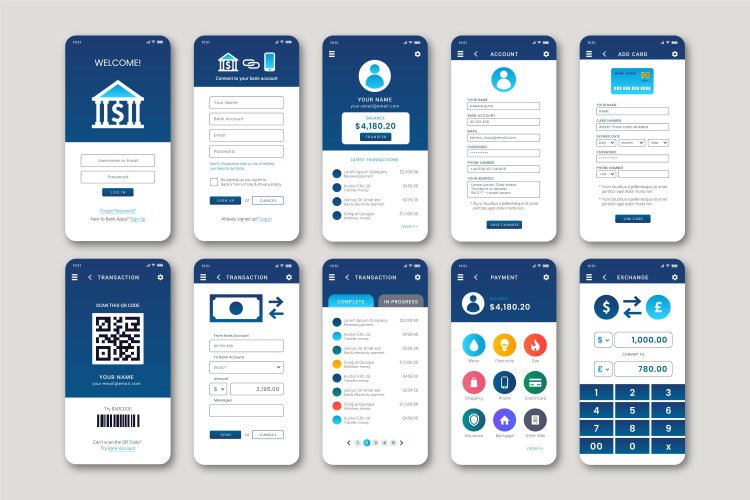

A fintech application is a cutting-edge financial technology tool designed to revolutionize how individuals and businesses manage their finances. These applications leverage advanced technologies like blockchain, artificial intelligence, and data analytics to provide users with seamless, secure, and efficient solutions for tasks such as payments, investments, and financial planning.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Introduction:

In the fast-paced world of finance, technology has emerged as a revolutionary force, giving rise to the term fintech — the convergence of finance and technology. Fintech applications have redefined the way we manage, invest, and transact money, offering innovative solutions that cater to the evolving needs of consumers and businesses alike. In this blog, we'll delve into the dynamic landscape of fintech applications, exploring their diverse offerings and the impact they've had on the financial industry.

The Rise of Fintech:

The rise of fintech can be attributed to several factors, including advancements in digital technology, increased connectivity, and changing consumer expectations. Traditional financial services are being disrupted as fintech companies leverage data analytics, artificial intelligence, and blockchain to create innovative products that streamline processes and enhance user experiences.

-

Digital Wallets and Payment Solutions:

One of the most visible aspects of fintech is the proliferation of digital wallets and payment solutions. Platforms like PayPal, Venmo, and Square Cash have transformed the way we handle transactions. Digital wallets allow users to link their bank accounts or credit cards, making it easy to send and receive money, pay bills, and even make contactless payments. The convenience and efficiency of these solutions have made traditional cash transactions seem antiquated.

-

Peer-to-Peer Lending:

Fintech has democratized lending through peer-to-peer (P2P) lending platforms. These platforms connect borrowers directly with individual lenders, cutting out traditional financial institutions. This not only provides borrowers with alternative financing options but also offers investors new avenues for diversifying their portfolios. Companies like LendingClub and Prosper have gained prominence, highlighting the success of P2P lending in reshaping the lending landscape.

-

Robo-Advisors:

Robo-advisors have brought investment management to the masses by combining algorithmic analysis with user-friendly interfaces. These automated platforms use algorithms to create and manage investment portfolios based on users' financial goals and risk tolerance. Wealthfront and Betterment are examples of robo-advisors that have gained traction, offering low fees and accessibility to novice investors.

-

Blockchain and Cryptocurrencies:

The advent of blockchain technology has given rise to cryptocurrencies, with Bitcoin and Ethereum leading the pack. Fintech applications in the form of cryptocurrency exchanges and wallets enable users to buy, sell, and store digital assets securely. The decentralized nature of blockchain technology has the potential to disrupt traditional banking systems, offering faster and more transparent transactions.

-

Insurtech Solutions:

The insurance industry has not been left untouched by fintech innovation. Insurtech companies leverage technology to streamline the insurance process, from underwriting to claims processing. Policyholders can now enjoy a more personalized and efficient experience, thanks to insurtech solutions that use data analytics to assess risk and tailor coverage.

Challenges and Opportunities:

While fintech applications have undoubtedly brought about positive changes, they also pose challenges and opportunities for the financial industry. Regulatory concerns, cybersecurity threats, and the need for interoperability are among the challenges that must be addressed to ensure the continued growth and stability of fintech.

Conclusion:

fintech application have emerged as a driving force, reshaping the financial landscape and challenging traditional models. From digital wallets to blockchain-based solutions, the fintech revolution shows no signs of slowing down. As technology continues to advance, we can expect even more innovative fintech applications to emerge, providing consumers and businesses with unprecedented financial solutions. The key lies in embracing these changes and navigating the evolving landscape to harness the full potential of fintech for a more inclusive and efficient financial future.

Lastly, if you are an owner of an app and want to list it on the top of the list on our website, you can visit Mobileappdaily.

Content Source - https://www.mobileappdaily.com/products/best-fintech-apps