Understanding the Importance of a Term Sheet in Business Deals

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Summary:

In the fast-paced world of business, especially in the startup ecosystem, deals are often the lifeblood of growth and innovation. Whether you are an entrepreneur looking for investment or an investor aiming to secure lucrative opportunities, understanding the foundational documents involved in these transactions is crucial. One such critical document is the Term Sheet.

The term sheet acts as a preliminary agreement that outlines the key terms and conditions of a business deal, providing a framework for the parties involved to proceed. In this blog, we will delve deep into what a term sheet is, its components, and why it matters for businesses.

What is a Term Sheet?

A term sheet is a non-binding document that sets forth the basic terms and conditions under which an investment will be made. Think of it as a blueprint for the final agreement. Typically, a term sheet is used in venture capital (VC) funding, mergers and acquisitions (M&A), and other strategic partnerships. Though it is not legally binding, a term sheet represents a mutual understanding between the parties and serves as the foundation for drafting legally binding agreements like stock purchase agreements or shareholder agreements.

Key Components of a Term Sheet

A well-drafted term sheet contains several essential components. Here are the most significant ones:

-

Valuation - The valuation section specifies how much the company is worth. This value determines the equity stake the investor will receive in return for their investment.

-

Investment Amount - This specifies the amount of money the investor is committing to the company.

-

Equity Structure - It outlines the percentage of ownership and the type of shares the investor will receive. Common types include common stock, preferred stock, or convertible securities.

-

Control Rights - This includes voting rights, board representation, and veto powers that the investor might hold.

-

Exit Strategies - The term sheet often outlines exit options for investors, such as IPOs, mergers, or buyouts.

-

Confidentiality and Exclusivity Clauses - These clauses ensure that the terms of the deal remain private and that the investor has a window of exclusivity to finalize the agreement.

-

Anti-Dilution Provisions - These provisions protect investors from losing equity value in case of subsequent funding rounds at a lower valuation.

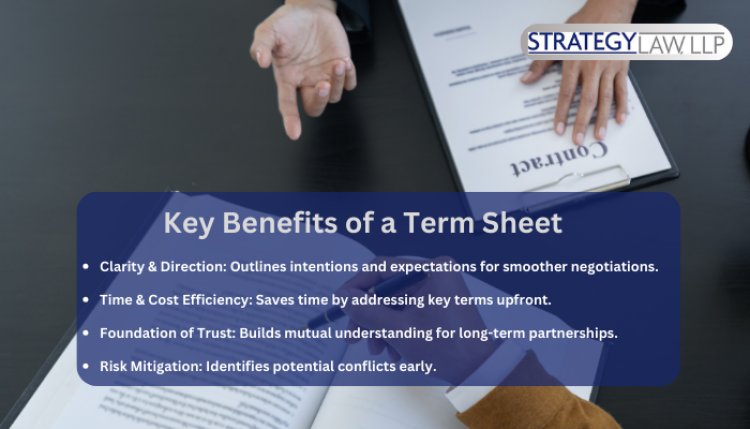

Why is a Term Sheet Important?

-

Clarity and Direction - A term sheet provides clarity on the intentions and expectations of both parties. This minimizes misunderstandings and ensures smoother negotiations.

-

Time and Cost Efficiency - By addressing the key terms upfront, a term sheet reduces the time and cost involved in drafting detailed legal agreements.

-

Foundation for Trust - It establishes a baseline of trust and mutual understanding, which is essential for long-term partnerships.

-

Negotiation Tool - The term sheet allows both parties to negotiate terms before significant legal expenses are incurred.

-

Risk Mitigation - It helps identify and address potential conflicts or deal breakers early in the process.

Common Pitfalls to Avoid

While a term sheet offers numerous benefits, it’s essential to approach it cautiously. Here are some common pitfalls to watch out for:

-

Overly Complex Terms - Avoid including overly complex or ambiguous terms that may lead to disagreements later.

-

Imbalanced Power Dynamics - Ensure that the terms are fair and balanced, protecting both parties’ interests.

-

Ignoring Legal Counsel - Even though a term sheet is non-binding, involving legal counsel ensures that the terms are clear, enforceable, and aligned with your goals.

-

Neglecting Confidentiality - Always include a confidentiality clause to protect sensitive information during negotiations.

Real-World Applications of a Term Sheet

To understand the significance of a term sheet, let’s consider its application in the startup world:

-

Venture Capital Funding - A startup seeking Series A funding may use a Term Sheet to outline the terms of the investment, such as the amount, valuation, and equity structure. This document serves as the basis for drafting a formal stock purchase agreement.

-

Mergers and Acquisitions - In an M&A deal, a term sheet helps the buyer and seller agree on essential aspects, such as the purchase price, payment terms, and closing conditions.

-

Joint Ventures - When two companies decide to collaborate, a term sheet lays out the scope, objectives, and resource allocation for the partnership.

How to Draft an Effective Term Sheet

Creating a comprehensive and effective term sheet requires careful consideration of both parties’ objectives. Here are some tips:

-

Be Clear and Concise - Use clear and concise language to avoid ambiguities.

-

Involve Professionals - Seek the assistance of legal and financial professionals to ensure the terms align with industry standards and legal requirements.

-

Focus on Key Terms - Prioritize the most critical terms and avoid unnecessary details.

-

Address Potential Risks - Anticipate potential challenges and include provisions to address them.

-

Use Templates Cautiously - While templates can be a good starting point, tailor the document to your specific needs and circumstances.

Building Trust Through Credible Resources

For a deeper understanding of the importance and structure of term sheets, you can refer to Wikipedia’s article on Term Sheets. This resource provides additional insights and context for those looking to deepen their knowledge.

Final Thought

The term Sheet is not just a document but a strategic tool that facilitates transparency, trust, and efficiency in business transactions. Whether you are a startup founder, an investor, or a business professional, understanding the nuances of a term sheet can significantly impact your success in negotiations. If you’re navigating the complexities of business agreements, seeking professional guidance can make all the difference. Strategy Law LLP is here to help you with all your business law needs, ensuring your interests are protected and your goals are achieved.

#TermSheet #BusinessLaw #StartupFunding #InvestorTips #BusinessGrowth #LegalInsights #StrategyLaw #NegotiationTips