Explore Most Popular Trading Patterns

Trading patterns are a fundamental piece of particular examination, but they require some becoming familiar with before they can be utilized successfully. To assist you with having the opportunity to holds with them.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Best trading patterns

- Head and shoulders

- Double top

- Double bottom

- Rounding bottom

- Cup and handle

- Wedges

- Pennant or flags

- Ascending triangle

- Descending triangle

- Symmetrical triangle

There is nobody ‘best’ trading pattern, since they are completely used to feature various patterns in a colossal assortment of business sectors. Frequently, graph designs are utilized in candle exchanging, which makes it somewhat more straightforward to see the past opens and closes of the market.

Many illustrations are more fit to an unpredictable market, while others are less so. A number of illustrations are best utilized in a bullish showcase, and others are best utilized when a advertise is negative.

That being said, it is basic to realize the ‘best’ trading pattern for your particular advertise, as utilizing a few unsatisfactory one or not knowing which one to utilize may make you pass up a potential chance to advantage.

Prior to getting into the complexities of various trading patterns, we must momentarily make sense of help and obstruction levels. Support alludes to the level at which a resource’s cost quits falling and quickly returns up. Opposition is where the cost generally quits rising and plunges down.

The explanation levels of help and obstruction seem is a direct result of the harmony among purchasers and dealers — or interest and supply. At the point when there are a greater number of purchasers than merchants in a market (or more interest than supply), the value will in general ascent. At the point when there are a larger number of merchants than purchasers (more stockpile than request), the cost normally falls.

For occasion, a resource’s fetched may be rising since ask is surpassing stock. In any case, the fetched will eventually arrive at the most prominent that buyers will pay, and ask will lessen at that taken a toll level. As of presently, buyers may select to shut their positions.

This makes opposition, and the value begins to fall toward a degree of help as supply overwhelms request as an ever increasing number of purchasers close their positions. When a resource’s cost falls enough, purchasers could get involved with the market in light of the fact that the cost is presently more satisfactory — making a degree of help where organic market start to rise to out.

Types of trading patterns

On the off chance that the expanded purchasing proceeds, it will drive the cost back up towards a degree of obstruction as request builds comparative with supply. When a cost gets through a degree of opposition, it might turn into a degree of help.

Graph designs fall extensively into three classes: continuation patterns, inversion patterns and two-sided patterns.

- A continuation pattern that a continuous pattern will proceed

- Inversion trading patterns demonstrate that a pattern might be going to head in a different path

- Respective outline designs let merchants in on that the cost could move one way or another — it is profoundly unpredictable to mean the market

For these examples, you can take a situation with CFDs. This is on the grounds that CFDs empower you to go short as well as lengthy — meaning you can estimate on business sectors falling as well as rising. You might wish to go short during a negative inversion or continuation, or long during a bullish inversion or continuation — whether you do so relies upon the pattern and the market examination that you have completed.

The most thing to recall whereas utilizing trading designs as a component of your specialized examination, is that they are not an affirmation that a showcase will move that expected way — they are basically a sign of what might happen to a resource’s taken a toll.

Head and shoulders

Head and shoulders is a trading pattern in which a huge pinnacle has a somewhat more modest top on one or the other side of it. Merchants take a gander at head and shoulders examples to foresee a bullish-to-negative inversion.

Regularly, the first and third pinnacle will be more modest than the second, yet they will the entire backup to a similar degree of help, also called the ‘neck area’. When the third pinnacle has fallen back to the degree of help, almost certainly, it will breakout into a negative downtrend.

Double top

A double top is one more example that brokers use to feature pattern inversions. Normally, a resource’s cost will encounter a top, prior to remembering back to a degree of help. It will then ascend again prior to turning around back more for all time against the prevailing trend.

Double bottom

A Double bottom trading pattern appears a time of advertising, making a resource’s fetched plunge beneath a degree of offer assistance. It’ll at that point rising to a degree of restriction, earlier to dropping once more. At long final, the pattern will banter and begin a vertical development as the advertise turns out to be more bullish.

A twofold base could be a bullish inversion design, since it suggests the wrap up of a downtrend and a move towards an uptrend.

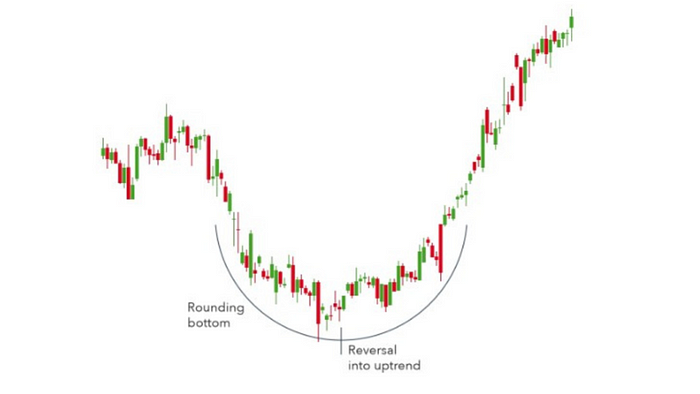

Rounding bottom

A rounding bottom trading pattern can mean a continuation or an inversion. Yet again for example, during an upturn a resource’s cost might fall back somewhat prior to rising. This would be a bullish continuation.

An example of a bullish reversal rounding bottom — shown below — would be on the off chance that a resource’s cost was in a descending pattern and an adjusting base framed before the pattern switched and entered a bullish upturn.

Traders will seek to capitalize on this pattern by purchasing most of the way around the base, at the depressed spot, and exploiting the continuation once it breaks over a degree of obstruction.

Cup and handle

The container and handle pattern may be a bullish continuation design that’s utilized to appear a time of negative market feeling before the general pattern at last go on in a bullish movement. The cup appears similar to a rounding bottom pattern, and the handle is like a wedge plan — which is made sense of within the taking after portion.

Taking after the adjusting foot, the taken a toll of a asset will likely enter an impermanent retracement, which is known as the handle since this retracement is confined to two break even with lines on the fetched trading. The asset will eventually alter out of the handle and go on with the by and expansive bullish pattern.

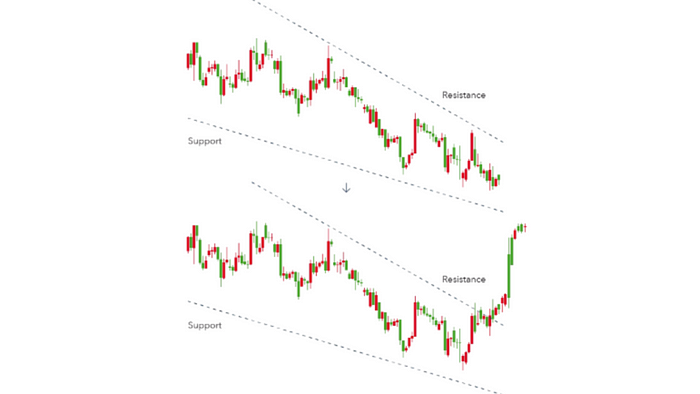

Wedges

Wedges structure as a resource’s cost developments fix between two inclining pattern lines. There are two kinds of wedge: rising and falling.

A rising wedge is addressed by a pattern line got between two upwardly skewed lines of help and obstruction. For this situation the line of help is more extreme than the obstruction line. This pattern generally signals that a resource’s cost will ultimately decline all the more for all time — which is shown when it gets through the help level.

A falling wedge happens between two downwardly inclining levels. For this situation the line of obstruction is more extreme than the help. A falling wedge is normally characteristic that a resource’s cost will rise and advancement the degree of obstruction, as displayed in the model underneath.

Both rising and falling wedges are inversion designs, with rising wedges addressing a negative market and falling wedges being more ordinary of a bullish market.

Pennant or flags

Pennant patterns, or flags, are made after a asset experiences a time of up improvement, trailed by a combination. By and huge, there will be a basic increase amid the starting stages of the pattern, some time recently it goes into a movement of more humble vertical and descending developments.

Pennants can be either bullish or negative, and they can address a continuation or an reversal. The over trading is an example of a bullish continuation. In this regard, pennants can be a sort of bilateral pattern since they appear either continuations or inversions.

While a pennant might show up to be like a wedge plan or a triangle design — made sense of within the taking after portions — it is imperative to note that wedges are smaller than pennants or triangles. Moreover, wedges differ from pennants since a wedge is always ascending or descending, whereas a pennant is always horizontal.

Ascending triangle

The ascending triangle is a bullish continuation pattern which implies the continuation of an upturn. Ascending triangles can be drawn onto traders by putting a horizontal line along the swing highs — the opposition — and afterward drawing a climbing pattern line along the swing lows — the help.

Ascending triangles frequently have at least two indistinguishable pinnacle highs which take into account the flat line to be drawn. The pattern line implies the generally speaking upswing of the example, while the flat line shows the notable degree of obstruction for that specific resource.

Descending triangle

In separate, a descending triangle proposes a negative continuation of a downtrend. Much of the time, a trader will enter a concise situation amidst a bouncing triangle — maybe with CFDs — trying to advantage from a falling trade segment.

descending triangles by and huge move lower and progress the assistance since they are normal for a plug overpowered by dealers, inducing that tenaciously lower tops are reasonable going to be inescapable and implausible to modify.

descending triangles can be perceived from an as a matter of fact line of proposition help and a plunging inclining line of counteraction. Finally, the arrangement will overcome the assistance and the downtrend will continue.

Symmetrical triangle

The even symmetrical triangle can be either bullish or negative, contingent upon the market. Regardless, it is typically a continuation design, and that implies the market will generally go on in a similar bearing as the general pattern once the example has framed.

Symmetrical triangles structure when the cost joins with a progression of lower tops and higher box. In the model underneath, the general pattern is negative, however the balanced triangle shows us that there has been a concise time of up inversions.

However, on the off chance that there is no unmistakable pattern before the triangle design shapes, the market could break out in one or the other course. his makes symmetrical triangles a bilateral pattern — meaning they are best utilized in unstable business sectors where there is no obvious sign of what direction a resource’s cost could move. An example of a two-sided balanced triangle should be visible underneath.

Read More: Over previous blog: futures trading

Trading patterns summed up

All of the patterns explained in this article are all valuable specialized markers which can assist you with understanding how or why a resource’s cost moved with a particular goal in mind — and what direction it could move from now on. This is on the grounds that trading patterns are fit for featuring areas of help and opposition, which can assist a merchant with concluding whether they ought to open a long or short position; or whether they ought to finish off their open situations in case of a potential pattern inversion.