Cyclohexanol Price Trend: In-Depth Market Analysis and Forecast for 2024

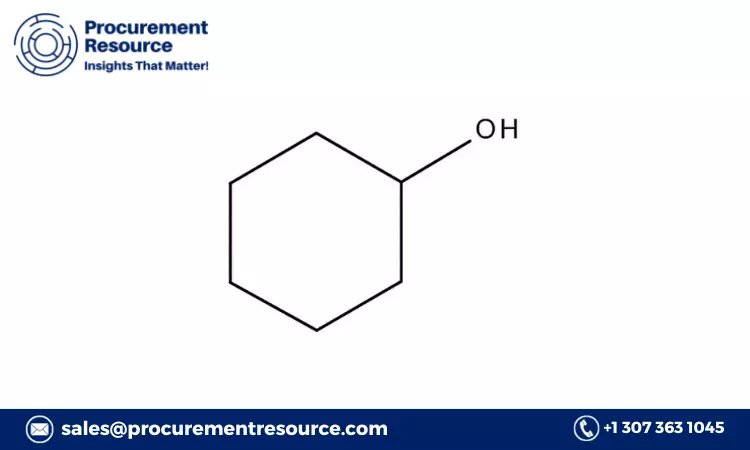

Cyclohexanol, a valuable industrial chemical used in the production of nylon, plasticizers, and solvents, plays a crucial role in several sectors, including automotive, construction, and textiles.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Cyclohexanol, a valuable industrial chemical used in the production of nylon, plasticizers, and solvents, plays a crucial role in several sectors, including automotive, construction, and textiles. The Cyclohexanol Price Trend is essential for businesses, investors, and manufacturers as it directly impacts production costs and pricing strategies. This detailed report provides insights into the current cyclohexanol price trend, an in-depth price analysis, an overview of the latest price chart, recent price news, a look at the price index, and a graphical representation of the price trend through a price graph.

1. Understanding the Cyclohexanol Price Trend

The Cyclohexanol Price Trend is influenced by multiple factors, including raw material costs, production capacity, global demand, and economic conditions. Cyclohexanol is primarily derived from cyclohexane, a petrochemical product. Consequently, cyclohexanol prices are closely tied to crude oil prices, which impact the cost of cyclohexane production.

Request Free Sample - https://www.procurementresource.com/resource-center/cyclohexanol-price-trends/pricerequest

In recent years, cyclohexanol prices have shown significant fluctuations due to shifts in raw material prices, changes in industrial demand, and the effects of global economic trends. Cyclohexanol is widely used in the production of nylon, which is essential in the automotive and textile industries, as well as in the manufacture of various plasticizers and solvents. Demand for these end products directly influences cyclohexanol pricing.

Additionally, as the global focus on sustainability grows, the demand for more environmentally friendly chemical production methods has increased. These trends, combined with seasonal variations and changes in the cost of raw materials, continue to shape the cyclohexanol price trend.

2. In-Depth Cyclohexanol Price Analysis

A comprehensive Cyclohexanol Price Analysis involves examining the factors that influence cyclohexanol pricing, such as production costs, demand from key industries, and market regulations.

Production Costs and Raw Material Availability

The production cost of cyclohexanol is closely tied to the price of cyclohexane, which is derived from crude oil. When crude oil prices rise, the cost of cyclohexane production typically increases, leading to higher cyclohexanol prices. Additionally, the cyclohexanol production process is energy-intensive, and fluctuations in energy prices can impact overall production expenses. Other factors affecting production costs include labor expenses and the availability of required chemical feedstocks.

Demand from the Nylon and Plasticizer Industries

Cyclohexanol is essential in the production of nylon, a material used extensively in the automotive and textile sectors. As demand for nylon grows, the demand for cyclohexanol is expected to increase, potentially driving up prices. Additionally, cyclohexanol is used to produce plasticizers and solvents, which are critical in the manufacturing of plastics and coatings. High demand from these industries can lead to price increases, while reduced demand may contribute to price stabilization or decline.

Influence of Environmental Regulations

Environmental regulations impact cyclohexanol production and pricing, particularly as more companies prioritize sustainable and eco-friendly practices. Compliance with these regulations often involves additional costs, which can be passed on to consumers in the form of higher prices. Companies that prioritize green chemistry and environmentally friendly production methods may also face increased operational expenses, potentially influencing cyclohexanol pricing.

3. Cyclohexanol Price Chart

A Cyclohexanol Price Chart provides a visual representation of price trends over time, helping stakeholders track price movements and understand how various factors impact pricing. Price charts typically display monthly or yearly data, allowing businesses and investors to observe how cyclohexanol prices respond to seasonal changes, economic events, and industry trends.

For example, a five-year cyclohexanol price chart may reveal price increases during periods of high demand, such as when the automotive and textile industries are expanding. Conversely, the chart may show price stabilization or decline during times of reduced demand or increased raw material availability. By examining a cyclohexanol price chart, manufacturers, suppliers, and investors can gain insights into how market conditions affect cyclohexanol prices, enabling them to make more informed purchasing and budgeting decisions.

Understanding these price movements is essential for businesses and consumers, especially those that rely on cyclohexanol for industrial or commercial applications. With a clear picture of historical trends, stakeholders can better anticipate potential price changes and plan their procurement and budgeting strategies accordingly.

4. Latest Cyclohexanol Price News

Staying updated on Cyclohexanol Price News is crucial for industry participants, as recent developments and trends directly impact market dynamics. As of 2024, several significant trends and events have shaped the cyclohexanol market:

-

Growth in the Automotive and Textile Industries: Demand for nylon in the automotive and textile sectors has contributed to higher demand for cyclohexanol. As these industries expand, particularly in emerging markets, the demand for cyclohexanol is expected to increase, potentially leading to higher prices.

-

Impact of Crude Oil Price Fluctuations: Changes in crude oil prices directly impact the cost of cyclohexane, which is essential for cyclohexanol production. Rising oil prices have led to higher cyclohexane production costs, which in turn affect cyclohexanol pricing. Conversely, when oil prices decline, the cost of cyclohexane production may decrease, leading to potential price stabilization or reduction.

-

Environmental and Regulatory Pressures: Stricter environmental regulations on chemical production are influencing the cyclohexanol market. Many companies are adopting sustainable practices, such as reducing emissions and using greener production methods. However, compliance with these regulations can lead to increased production costs, potentially driving up cyclohexanol prices.

-

Technological Advancements in Production: Innovations in chemical synthesis and production technologies are helping manufacturers improve yield and efficiency, potentially reducing production costs over time. These technological advancements may contribute to more stable cyclohexanol prices, as production processes become more efficient.

Monitoring cyclohexanol price news is crucial for understanding the factors that influence pricing. By staying informed about market events, stakeholders can better anticipate potential price movements and adjust their strategies to align with changing conditions.

5. Cyclohexanol Price Index

The Cyclohexanol Price Index is a valuable tool for tracking average price movements over time, providing a benchmark for comparing current prices with historical levels. The index aggregates data from various sources, offering a comprehensive view of cyclohexanol price trends.

The cyclohexanol price index is influenced by factors such as global demand, supply availability, economic conditions, and production costs. In recent years, the index has shown increased volatility due to shifts in demand from the automotive and textile sectors, changes in raw material pricing, and environmental regulations. By examining the cyclohexanol price index, businesses and consumers can gauge whether current prices are in line with historical trends, helping them make strategic decisions regarding purchasing, budgeting, and inventory management.

The index is particularly useful for nylon manufacturers, chemical suppliers, and investors who rely on cyclohexanol. By monitoring the price index, companies can better understand market dynamics and anticipate future price movements based on broader trends.

6. Cyclohexanol Price Graph

A Cyclohexanol Price Graph provides a visual representation of price trends over specific periods, making it easier to identify short-term fluctuations and long-term patterns. Price graphs are especially useful for observing how various factors, such as seasonal demand changes, economic conditions, and market sentiment, impact cyclohexanol pricing.

For instance, a one-year price graph may show increased prices during periods of high demand in the automotive or textile sectors. The graph can also highlight price drops during times of lower demand or when raw material costs decline. By analyzing the price graph, businesses and consumers can gain insights into how different factors influence cyclohexanol prices and adjust their purchasing strategies accordingly.

Regional price graphs can offer insights into how cyclohexanol prices vary across different markets. For example, prices may be higher in regions with limited production capacity or lower in areas with abundant resources. This information is valuable for companies that operate in multiple regions, as it allows them to optimize their sourcing strategies based on local market conditions.

About Us:

Procurement Resource is an invaluable partner for businesses seeking comprehensive market research and strategic insights across a spectrum of industries. With a repository of over 500 chemicals, commodities, and utilities, updated regularly, they offer a cost-effective solution for diverse procurement needs. Their team of seasoned analysts conducts thorough research, delivering clients with up-to-date market reports, cost models, price analysis, and category insights.

By tracking prices and production costs across various goods and commodities, Procurement Resource ensures clients receive the latest and most reliable data. Collaborating with procurement teams across industries, they provide real-time facts and pioneering practices to streamline procurement processes and enable informed decision-making. Procurement Resource empowers clients to navigate complex supply chains, understand industry trends, and develop strategies for sustainable growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Amanda Williams

Email: sales@procurementresource.com

Toll-Free Number: USA Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

AmandaWilliams

AmandaWilliams