Can You Plan Investor Goals in Mutual Fund Software for IFA?

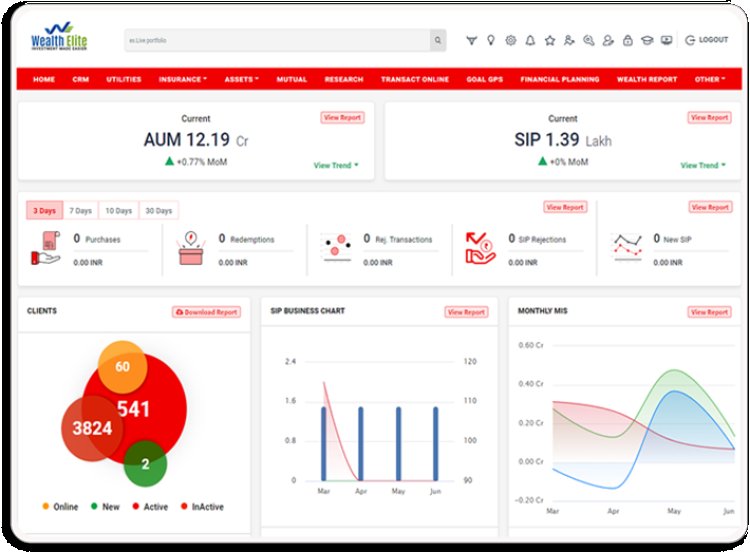

As a mutual fund distributor, one of your main responsibilities is helping your clients plan and achieve their financial goals. With the right mutual fund software for IFA, you can make this process smoother and more efficient.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

As a mutual fund distributor, one of your main responsibilities is helping your clients plan and achieve their financial goals. With the right mutual fund software for IFA, you can make this process smoother and more efficient. Let’s explore how you can plan investor goals using such software and why it’s beneficial.

Quick Goal Planning Made Easy

One of the standout features of wealth management software in India is the ability to quickly set up and plan for various investor goals. Here are some common goals you can plan for:

- Car Planning:Whether your client wants to buy their first car or upgrade to a new one, you can set a financial goal that outlines the amount needed and the timeline for achieving it.

- Child Marriage:Planning for a child’s marriage can be financially demanding. The software allows you to project future costs and create a savings plan that ensures your client can meet this significant expense.

- Education:Education costs are rising, and many parents want to secure their children's future. With the software, you can estimate the amount needed for different stages of education, from primary school to university, and set up a systematic investment plan.

- Holiday Planning:Everyone needs a break, and helping your clients save for a dream vacation can be a delightful task. You can define the cost of the holiday and set a savings goal accordingly.

- House Planning:Buying a home is one of the biggest investments. The software helps in setting a realistic goal, considering down payment and mortgage plans, making it achievable within your client’s desired timeframe.

- Retirement Planning:Ensuring a comfortable retirement is crucial. You can create a detailed retirement plan, considering factors like inflation and living expenses, to help your clients retire without financial stress.

- Self-Education:Lifelong learning is valuable. If your client wants to invest in their own education, such as taking a course or pursuing a degree, you can set up a financial goal to cover these costs.

Personal Touch with Family Photos

Adding a personal touch can make goal setting more engaging. Some software allows you to attach a family photo to each goal. This visual element can motivate your clients by reminding them of the loved ones they are planning for and the future they envision.

Mapping Existing Funds

Another powerful feature is the ability to map existing funds to the planned goals. You can take a client’s current investments and align them with their goals. This mapping helps in understanding if the existing funds are sufficient or if there is a need to invest more.

Tracking Goals

Planning is just the beginning. Tracking the progress of these goals is equally important. Regular updates and progress reports can be generated, showing how close your clients are to achieving their goals. If there are any shortfalls or the market conditions change, you can adjust the investment strategy accordingly. This proactive approach helps in making timely decisions, ensuring that your clients’ financial plans remain on track.

Conclusion

In conclusion, MFD software is an invaluable tool for planning and achieving investor goals. It simplifies the process of setting up various financial goals, mapping existing funds, and tracking progress, making your job as a mutual fund distributor easier and more effective. By using this software, you can provide your clients with personalized, detailed, and actionable financial plans, helping them achieve their dreams and secure their financial future.