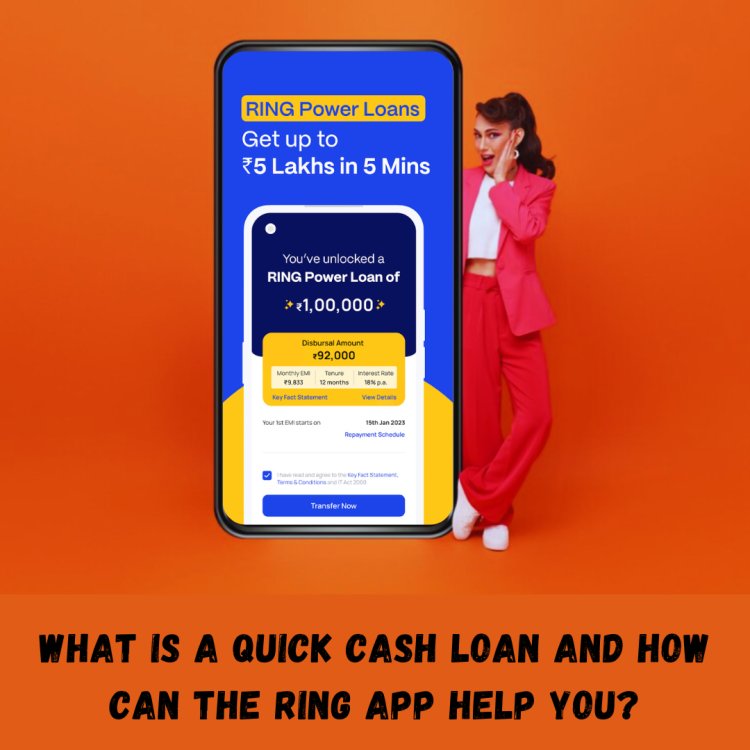

What is a Quick Cash Loan and How Can the RING App Help You?

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

In today’s fast-paced world, having access to quick cash can make all the difference in managing financial emergencies or unexpected expenses. Traditional loan processes often involve lengthy approval times, a lot of paperwork, and waiting periods that aren’t suitable for urgent needs. This is where instant loans apps like the RING app come into play, offering a simple and efficient solution for fast financial relief.

What is a Quick Cash Loan?

A fast cash loan is a type of loan designed to provide immediate financial assistance with minimal documentation and quick approval processes. Unlike traditional loans that might require weeks for approval and disbursal, instant personal loan or instant cash are made available quickly, often within a few hours. They are intended to help you cover urgent financial needs such as medical bills, car repairs, or unexpected expenses, without the hassle of going through complicated procedures.

These personal loans are typically smaller amounts compared to regular loans, making them ideal for covering short-term financial gaps. The flexibility in repayment terms also makes it a convenient solution for many people, especially when they don’t have the time or resources to undergo traditional loan processes.

Key Features of Quick Cash Loans

Quick loan have become a popular financial tool for individuals facing unexpected expenses or emergencies. These loans provide fast access to funds with minimal paperwork and quicker approval times compared to traditional loans. Below are the key features that make quick cash loans a go-to option for many:

1. Fast Approval and Disbursement

One of the most prominent features of quick cash loans is the speed at which they are approved and disbursed. Once you apply, the approval process is often completed in a matter of minutes, and the funds are disbursed to your bank account or mobile wallet almost instantly. This makes it ideal for those who need money urgently.

2. Simple Application Process

The application process for quick loan is designed to be straightforward. Most loan app allow you to apply through a mobile phone or website with minimal paperwork. Typically, you’ll need to provide personal details, income information, and the amount you wish to borrow. This ease of access is perfect for individuals who may not have the time or resources for lengthy paperwork.

3. Flexible Loan Amounts

Unlike traditional loans that may require large amounts of money or significant collateral, quick cash loans often offer smaller amounts. This flexibility allows you to borrow only what you need for short-term expenses. Loan amounts can vary based on the lending platform and the borrower's eligibility.

4. No Collateral Required

In most cases, quick cash loans are unsecured, meaning you do not need to provide collateral (such as property or assets) to secure the loan. This makes it an excellent choice for individuals who don’t have valuable assets or don’t want to risk their property.

5. Short-Term Repayment Options

Quick loans typically come with short repayment periods, ranging from a few weeks to a few months. The short repayment terms mean that you are not tied down for a long time, allowing you to settle your debt quickly and move on. Flexible repayment schedules are often available, so you can choose the option that works best for your financial situation.

6. Minimal Documentation

Traditional loans usually require extensive documentation, including proof of income, bank statements, and employment verification. However, quick cash loans often require minimal documentation, with many loan apps needing just basic personal details, such as your ID and income source. This makes the process much faster and easier.

7. Available Through Loan Apps

Many personal loan app online provide a fast and convenient way to apply for loans. These loan apps allow you to apply, manage, and track your loans directly from your smartphone, making them accessible anytime and anywhere.

8. No Hidden Fees

Unlike some traditional loan providers, many quick cash loans come with transparent terms and no hidden fees. The interest rates and fees are clearly outlined before you sign the loan agreement, so you won’t be surprised by extra costs.

9. Instant Payment

Once your loan is approved, the instant payment feature ensures that the funds are credited to your bank account or digital wallet immediately. This feature is particularly useful for emergencies, where waiting for approval or disbursement could delay essential services.

10. Availability of Small Loan Options

Small loans app are a common offering with instant cash loans, allowing you to borrow smaller amounts. These loans are typically used for short-term needs, such as paying bills, emergency medical costs, or car repairs.

11. Easy Eligibility Criteria

The eligibility criteria for quick cash loans are often more relaxed than those for traditional loans. While factors like income and credit score may still be considered, the requirements are typically less stringent, making it easier for a wider range of individuals to qualify.

12. Safe and Secure Transactions

Most trusted loan apps and platforms prioritize the security of their customers. With encryption and secure online payment gateways, your personal and financial information remains protected throughout the loan application and disbursement process.

Why Choose the RING App?

With the rise of technology, getting a loan online has never been easier. Mobile loans apps are becoming increasingly popular, and one standout app in the industry is the RING app. This trusted loan platform makes accessing instant funds simple, fast, and secure.

-

Speed and Convenience: With instant approval and fast cash disbursement, you can access funds within minutes. Whether it's for medical bills, urgent home repairs, or other emergency expenses, the RING app helps you resolve financial issues without delay, offering a quick and efficient solution.

-

Secure and Trusted: The app prioritizes your data security by using advanced encryption technology, ensuring that your personal information is safe throughout the process. With no hidden fees and transparent lending practices, it offers a trusted loan app experience, giving you confidence in every transaction.

-

Easy to Use: Applying for a personal loan online is effortless with the RING app. You can submit your application in just a few taps, and the process is designed to be quick and hassle-free, making it ideal for those who need a loan but don’t want to deal with lengthy paperwork or complicated procedures.

Conclusion

In summary, quick loans are an essential tool for managing urgent financial situations. With the help of loan apps like the RING app, you can access mobile loans quickly and securely, without the typical delays of traditional banking systems. The RING app makes borrowing money as easy as a few clicks, offering a reliable and efficient solution for your instant loan needs.

Whether you need a personal loan for an unexpected expense or a fast loan for personal use, the RING app provides a trusted loan experience that is both simple and efficient.