Top Early Stage Venture Capital Firms to Watch in 2024

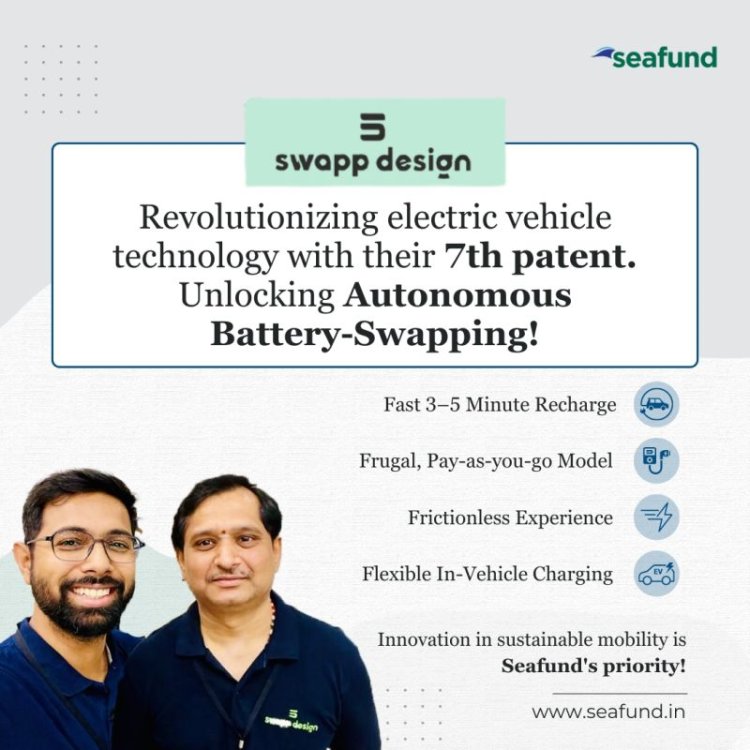

Seafund, a prominent player among early-stage venture capital firms, is backing up SwappDesign, a company building an advanced battery-swapping solution for EVs in India.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Tune into to Podcast to know more about funding for startups and managing startup finances.

Seafund, a prominent player among early-stage venture capital firms, is backing up SwappDesign, a company building an advanced battery-swapping solution for EVs in India.

Are you an innovative startup looking for investment and mentorship? Early-stage venture capital firms can provide the crucial support and funding needed to bring your ideas to life and scale your business. These firms specialize in investing in startups with high growth potential, offering not just capital but also valuable industry expertise and networks.

Key Benefits of Early-Stage Venture Capital Firms:

- Access to Capital: Secure the necessary funding to develop your product, hire key talent, and expand your operations.

- Mentorship and Guidance: Benefit from the experience and insights of seasoned investors and industry experts.

- Networking Opportunities: Gain access to a broad network of entrepreneurs, potential partners, and customers.

- Strategic Support: Receive assistance in refining business strategies, improving product offerings, and navigating challenges.

Learn how SEA Fund is partnering with startups like SWAPP Design to drive innovation and success. SEA Fund is a leading early-stage venture capital firm, committed to nurturing startups and helping them reach their full potential.

We embrace a contrarian spirit, for ideas too obvious can swiftly become overcrowded. With our expanding portfolio, we envision becoming the go-to destination for these groundbreaking ideas and the visionary entrepreneurs behind them.

Seeking investment?

If you have an innovative startup or business that aligns with our investment focus, we would love to hear from you.

The interim Union Budget 2024 presents a mixed outcome for startups, deep tech, and sustainability. While it offers tax breaks and funding schemes, especially for green tech, direct support for deep tech innovations remains limited. Experts suggest that targeted measures could enhance the adoption of emerging technologies.

In this article Narendra Bhandari of Seafund, an early stage venture capital firm, highlights the growing significance of patient capital for deep tech startups, supporting sectors like semiconductors, clean energy, and biosciences.

Despite challenges such as complex evaluations and the need for strong advisory networks, Seafund's investments in robotics and drone-based logistics align with the budget's evolving focus.

For more insights, visit the full article here.

Visit SEA Fund — SWAPP Design Portfolio to explore their portfolio and learn more about how they support early-stage ventures in achieving their business goals.

#305, 3rd Floor, 5 Vittal Mallya Road, Bengaluru, Karnataka, 560001, India