Small Satellite Market Size, Growth, Key Players, Opportunity and Forecast 2025-2033

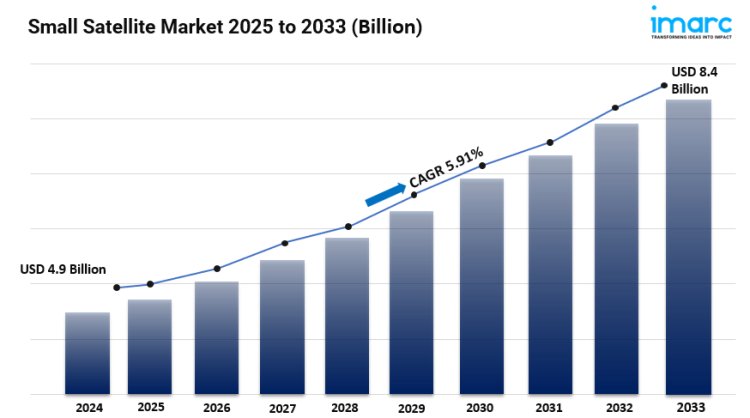

The small satellite market is expected to reach USD 8.4 billion by 2033, exhibiting a CAGR of 5.91% during 2025-2033.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

IMARC Group, a leading market research company, has recently releases report titled “Small Satellite Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033,” The study provides a detailed analysis of the industry, including the global small satellite market size, share, growth, trends and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the small satellite market?

The global small satellite market size was valued at USD 4.9 billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.4 billion by 2033, exhibiting a CAGR of 5.91% during 2025-2033.

Factors Affecting the Growth of the Small Satellite Industry:

- Proliferation of Mega-Constellations and LEO Expansion:

A big factor driving the small satellite market is the rapid rise of mega-constellations, especially in Low Earth Orbit (LEO). Companies like SpaceX (Starlink), Amazon (Project Kuiper), and OneWeb are launching thousands of small satellites for global internet access. This change is making small satellites essential for telecommunications. The low cost of launching in LEO, shorter latency than geostationary orbits, and the ability to scale networks have driven this growth.. Commercial entities and governments are investing more in LEO systems. They focus on national security, remote sensing, and Earth observation. As the need for connectivity grows, especially in underserved areas, these constellations will likely lead launch schedules for the next decade.This trend leads to a sharp increase in satellite deployments and a wider range of payloads. It creates new growth opportunities in ground stations, data analytics, and satellite servicing.

- Miniaturization and Technological Innovation:

Another key market trend is the miniaturization of satellite parts. This has made small satellites, usually under 500 kg, including CubeSats, more capable and affordable. Advances in microelectronics, modular design, propulsion, and solar technology have cut down the size, weight, and power needs of satellites while boosting their performance. Now, small satellites can carry high-resolution sensors, inter-satellite communication systems, and AI tools for data processing. These enhancements allow small satellites to take on missions once meant for larger, pricier platforms. Lower manufacturing and launch costs have opened access to space for startups, universities, and developing nations.This wave of innovation leads to competition. Here, agility, quick market entry, and customization matter more than old-school, long-term programs with large budgets. As a result, the small satellite sector is becoming a testing ground for new technologies and business models in space operations.

- Rising Demand for Earth Observation and Climate Monitoring:

Earth observation is driving demand for small satellites. Environmental concerns and climate change are major factors. Governments, NGOs, and businesses are using small satellite constellations for many purposes. These include imaging, weather forecasting, agricultural monitoring, disaster management, and urban planning. Small satellites can revisit areas often and deliver real-time data. This gives them an edge over traditional Earth observation systems. Companies are now investing in hyperspectral, multispectral, and synthetic aperture radar (SAR) technologies. These can fit into smaller satellite platforms. The global focus on sustainability and resource management increases the need for space-based data. ESG (Environmental, Social, and Governance) reporting also fuels this demand. Consequently, Earth observation services are shifting from occasional snapshots to ongoing, detailed monitoring platforms. This change is powered by fleets of agile small satellites.

Request for a sample copy of this report: https://www.imarcgroup.com/small-satellite-market/requestsample

Small Satellite Market Report Segmentation:

Breakup by Component:

- Payloads and Structures

- Electric Power System

- Solar Panels and Antenna System

- Propulsion System

- Others

Breakup by Type:

- Mini Satellite

- Micro Satellite

- Nano Satellite

- Others

Breakup by Frequency:

- L-Band

- S-Band

- C-Band

- X-Band

- Ku-Band

- Ka-Band

- Q/V-Band

- HF/VHF/UHF-Band

- Others

Breakup by Application:

- Communication

- Earth Observation and Remote Sensing

- Science and Exploration

- Mapping and Navigation

- Space Observation

- Others

Breakup by End User:

- Commercial

- Academic

- Government and Military

- Others

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Global Small Satellite Market Trends:

The small satellite market is experiencing significant transformation, driven by rapid advancements in technology, growing commercial interest, and increasing demand for data-driven services across various industries. One of the most notable trends is the rising number of satellite constellations being deployed in Low Earth Orbit (LEO). These constellations consist of hundreds or thousands of small satellites. They mainly provide global broadband internet, Earth observation, and communication networks. Major companies like SpaceX, OneWeb, and Amazon are investing billions in these mega-constellation projects. Their goal is global coverage and low-latency connectivity. This shift to LEO is possible due to lower costs for satellite manufacturing and launch services. This change has opened the market for startups, universities, and governments in emerging space nations.

Who are the key players operating in the industry?

The report covers the major market players including:

- AAC Clyde Space

- Airbus SE

- Ball Corporation

- Blue Canyon Technologies (Raytheon Technologies Corporation)

- Exolaunch Gmbh

- GomSpace

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- Millennium Space Systems Inc. (The Boeing Company)

- Northrop Grumman Corporation

- Spire Global Inc.

- The Aerospace Corporation

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=6120&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

MattWatson27

MattWatson27