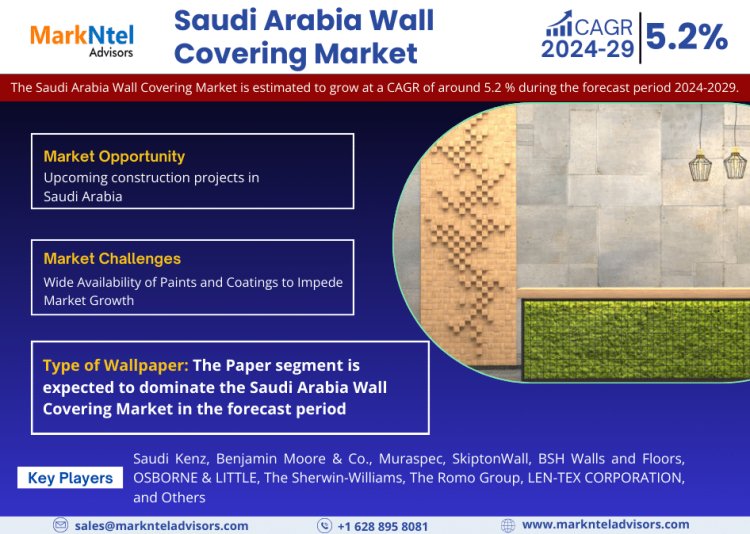

Saudi Arabia Wall Covering Market Size 2024-2029: Saudi Kenz, Benjamin Moore & Co., Muraspec, SkiptonWall, BSH Walls and Floors, OSBORNE & LITTLE

Saudi Arabia Wall Covering Market Size 2024-2029: Saudi Kenz, Benjamin Moore & Co., Muraspec, SkiptonWall, BSH Walls and Floors, OSBORNE & LITTLE

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

According to MarkNtel Advisors study the Saudi Arabia Wall Covering Market is estimated to grow at a CAGR of around 5.2 % during the forecast period, i.e., 2024-2029.

“In case you missed it, we are currently revising our reports. Click on the below to get the most latest research data with forecast for years 2024 to 2030, including market size, industry trends, and competitive analysis. It wouldn't take long for the team to deliver the most recent version of the report.”

Access Free Sample Report - https://www.marknteladvisors.com/query/request-sample/saudi-arabia-wall-covering-market.html

Key Findings of the Study: Saudi Arabia Wall Covering market

Saudi Arabia Wall Covering Market Driver:

Increasing Tourism and Expansion of Hospitality Sector – Saudi Arabia has been promoting its tourism to diversify its economy which has led to a surge in its tourism sector. The country has been providing instant e-visas to amplify connectivity and tourism in the country. Moreover, the government has been providing funds for the tourism industry. For Instance,

- In 2022, the country recorded 93.5 million tourist visits from across the globe, and the total investment in 2023 (Multiple Phases of completion) for tourism was about USD 800 billion.

To accommodate the increasing number of tourists, Saudi Arabia has witnessed rapid growth in its hospitality sector including the construction of hotels, restaurants, and resorts among others. The rise in luxury and premium hotel construction has been creating the demand for aesthetic, new, and unique interiors and wallcovering for decoration. In addition, wallcoverings with higher durability, stain resistance, and ease of cleaning are making them a practical choice for the hospitality industry which is ultimately driving the growth of Saudi Arabia's Wallcoverings Market.

Saudi Arabia Wall Covering Market Challenge:

Wide Availability of Paints and Coatings to Impede Market Growth – Paints and coatings provide a cost-effective way to decorate and protect walls. In a market where these products are widely available, consumers may be less inclined to consider wallcoverings as an alternative. In addition, the installation of paints is generally easier and quicker to apply than wallcoverings. Touch-ups and repairs are straightforward, and paint over existing paint could be done without significant issues. The maintenance of paints and coatings is much easier as compared to wallcoverings which need cautious caring in handling and renovation which might affect the overall growth of the wall covering market in Saudi Arabia.

For more detailed information about the Saudi Arabia Wall Covering market report, click here – https://www.marknteladvisors.com/research-library/saudi-arabia-wall-covering-market.html

Scope of the Report and Saudi Arabia Wall Covering Market Segmentation:

By Type of Wallpaper

- Paper- Market Size & Forecast 2019-2029, (USD Million)

- Textile- Market Size & Forecast 2019-2029, (USD Million)

- Vinyl- Market Size & Forecast 2019-2029, (USD Million)

- Non-Woven- Market Size & Forecast 2019-2029, (USD Million)

By Application

- Residential- Market Size & Forecast 2019-2029, (USD Million)

- Commercial Buildings- Market Size & Forecast 2019-2029, (USD Million)

- Hospitality- Market Size & Forecast 2019-2029, (USD Million)

- Government & Transport- Market Size & Forecast 2019-2029, (USD Million)

- Others (Industrial, etc.) - Market Size & Forecast 2019-2029, (USD Million)

By Distribution Channel

- Direct Sales- Market Size & Forecast 2019-2029, (USD Million)

- Indirect Sales- Market Size & Forecast 2019-2029, (USD Million)

- Dealers & Distributors- Market Size & Forecast 2019-2029, (USD Million)

- Speciality Stores- Market Size & Forecast 2019-2029, (USD Million)

- E-commerce Websites- Market Size & Forecast 2019-2029, (USD Million)

Out of them all, the paper segment is expected to dominate the Saudi Arabia Wall Covering Market in the forecast period.

Saudi Arabia Wall Covering Market Development:

- 2023: Muraspec launched six new wall covering designs, Trilogy, Cosmia, Symmetry, Gilded, and Insignia. The designs have different colors and themes with specific patterns.

- 2022: Muraspec announced its latest Shimmer design to expand its product portfolio of wide-width contract wallcoverings.

Note: If you require specific information not covered in the current report, we can provide it through customized option

Why choose Us?

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

For Media Inquiries, Please Contact:

Call: +1 628 895 8081 | +91 120 4278433

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India