Mexico Generic Drug Market Report 2025 Edition: Industry Size, Share, Growth and Competitor Analysis

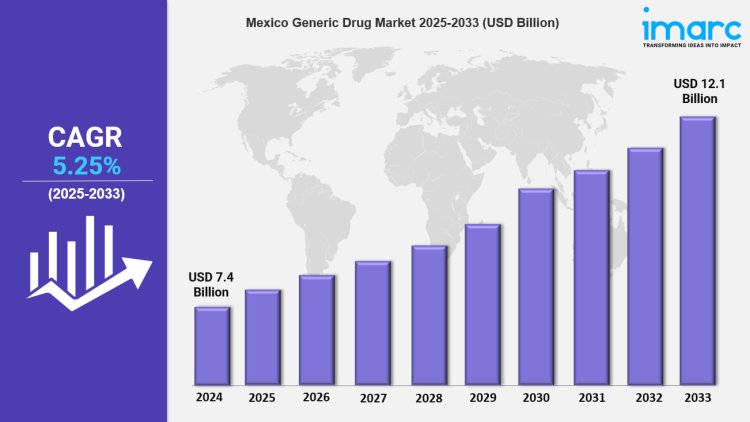

Mexico generic drug market size reached USD 7.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.25% during 2025-2033.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Market Overview 2025-2033

Mexico generic drug market size reached USD 7.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.25% during 2025-2033. The market is witnessing substantial growth, fueled by rising healthcare costs, increased access to healthcare services, and a growing aging population. Key trends include the demand for affordable medication options, with major pharmaceutical companies focusing on expanding their generic drug portfolios and enhancing distribution channels. As consumers become more health-conscious and seek cost-effective alternatives to branded drugs, the market is shifting towards greater acceptance of generics.

Key Market Highlights:

✔️ Significant growth driven by rising healthcare costs and increased access to medications

✔️ Growing demand for affordable generic alternatives among consumers and healthcare providers

✔️ Enhanced focus on regulatory support and initiatives promoting the use of generic drugs

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-generic-drug-market/requestsample

Mexico Generic Drug Market Trends and Driver:

The Mexico Generic Drug Market is experiencing notable growth, primarily driven by the increasing accessibility of healthcare services across the country. As more individuals gain access to health insurance and medical facilities, the demand for affordable medications is rising. This trend is particularly significant in rural and underserved areas, where generic drugs offer a cost-effective solution for patients seeking necessary treatments. By 2025, the Mexico Generic Drug Market Size is expected to expand as healthcare providers and pharmacies enhance their offerings of generic medications.

The government's efforts to promote the use of generics through policies and educational campaigns are further fueling this growth. As a result, patients are becoming more aware of the benefits of generic drugs, contributing to a larger market share for generic pharmaceutical companies. This shift not only supports public health initiatives but also drives competition among manufacturers, leading to improved quality and availability of generic products in the market.

The demand for cost-effective medications is a significant driver in the Mexico Generic Drug Market. As healthcare costs continue to rise, both consumers and healthcare providers are increasingly turning to generic alternatives to branded drugs. This trend is particularly pronounced among chronic disease patients who require long-term medication, as affordability becomes a critical factor in treatment adherence. By 2025, the Mexico Generic Drug Market Growth is anticipated to accelerate as more healthcare professionals recommend generics to their patients.

The increasing acceptance of generics among consumers, coupled with the growing number of generic drug approvals, is reshaping the pharmaceutical landscape. Major players in the market are responding by expanding their product lines and enhancing marketing strategies to emphasize the efficacy and safety of generic options. This focus on affordability not only benefits consumers but also strengthens the overall healthcare system by reducing financial burdens on patients and insurers alike.

Regulatory support is playing a crucial role in shaping the Mexico Generic Drug Market, fostering an environment conducive to growth and innovation. The Mexican government has implemented various initiatives aimed at promoting the development and use of generic medications, including streamlined approval processes and incentives for manufacturers. By 2025, these regulatory measures are expected to contribute significantly to the Mexico Generic Drug Market Size, as they encourage new entrants and stimulate competition among existing players.

Additionally, advancements in manufacturing technologies and quality control are enhancing the production capabilities of generic drug companies, leading to improved product offerings. The combination of supportive regulations and industry innovation is not only increasing the market share of generics but also ensuring that patients have access to high-quality, affordable medications. As the market continues to evolve, the emphasis on regulatory compliance and innovation will be key factors driving sustained growth in the generic drug sector.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=16372&flag=CMexico Generic Drug Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Therapy Area Insights:

- Central Nervous System

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology

- Diabetes

- Oncology

- Others

Drug Delivery Insights:

- Oral

- Injectables

- Dermal/Topical

- Inhalers

Distribution Channel Insights:

- Retail Pharmacies

- Hospital Pharmacies

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145