Managed Services Market Size, Growing Demand and Upcoming Opportunities till 2032

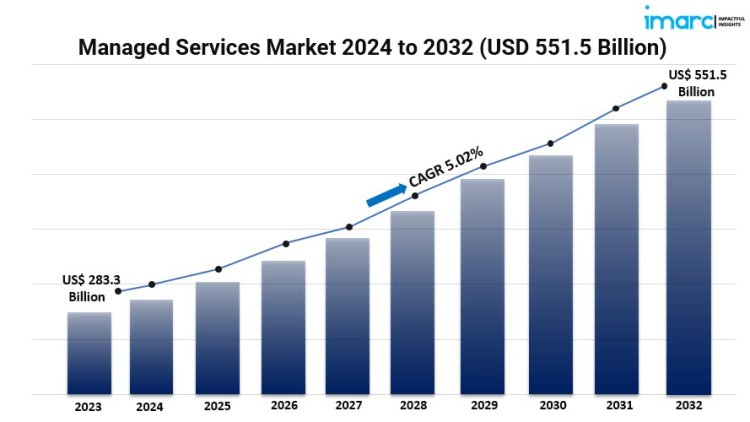

Managed services market size reached US$ 283.3 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 551.5 Billion by 2032, exhibiting a growth rate (CAGR) of 7.5% during 2024-2032.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

The latest report by IMARC Group, titled “Managed Services Market Report by Type (Managed Infrastructure, Managed Data Center, Managed Security, Managed Communications, Managed Network, Managed Mobility), Deployment Mode (On-premises, Cloud-based), Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), End Use (IT and Telecommunication, BFSI, Healthcare, Entertainment and Media, Retail, Manufacturing, Government, and Others), and Region 2024-2032”, offers a comprehensive analysis of the industry, which comprises insights on the market. The global managed services market size reached US$ 283.3 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 551.5 Billion by 2032, exhibiting a growth rate (CAGR) of 7.5% during 2024-2032.

Managed Services Industry Trends and Drivers:

- Growing Demand for Cloud-Based Managed Services:

The rise of cloud computing has significantly impacted the managed services market, as more businesses are transitioning to cloud environments for scalability and flexibility. Cloud-based managed services offer organizations the ability to outsource complex IT infrastructure, allowing them to focus on core business activities while reducing operational costs. The demand for managed cloud services continues to grow as companies seek seamless integration, improved data management, and enhanced cybersecurity measures. The scalability offered by cloud services enables businesses to adjust resources based on current needs without the constraints of traditional on-premises systems. Furthermore, cloud-based managed services provide faster disaster recovery options and data backup capabilities, making them more appealing to businesses prioritizing data security and continuity. As cloud adoption rises across industries, managed services providers (MSPs) are increasingly focusing on offering robust cloud management solutions to remain competitive in the evolving market.

- Increased Focus on Cybersecurity Solutions:

With the increasing number of cyber threats and data breaches, businesses are prioritizing security in their managed services partnerships. Managed security service providers (MSSPs) are experiencing heightened demand as companies seek advanced cybersecurity solutions to protect their sensitive data and IT infrastructure. From threat detection and prevention to compliance management, MSSPs are providing businesses with tailored security services to mitigate risks. As cybersecurity regulations become stricter, especially with the introduction of data protection laws such as the GDPR and CCPA, organizations are relying on managed services to maintain compliance and protect against potential fines or reputational damage. Additionally, the rise of remote work has intensified the need for robust security frameworks to safeguard networks and endpoints. This growing focus on cybersecurity is driving significant investment in managed security services, making it one of the most important trends in the market.

- Shift Toward Outcome-Based Service Models:

The managed services market is witnessing a shift from traditional time-and-materials contracts to outcome-based service models, where businesses pay for the results or performance of the services provided. This change is driven by the need for predictable outcomes, cost efficiency, and alignment of service provider incentives with client goals. Outcome-based models allow companies to set specific performance metrics or business objectives that service providers must meet, ensuring a more value-driven partnership. This trend is particularly popular in industries with mission-critical operations, such as healthcare, finance, and manufacturing, where performance and uptime are essential. Managed services providers (MSPs) are embracing this approach to differentiate themselves in the market and offer more flexibility to their clients. As businesses increasingly demand measurable outcomes and return on investment (ROI) from their IT services, the outcome-based model is expected to become a standard practice in the managed services industry.

For an in-depth analysis, you can request a sample copy of the report: https://www.imarcgroup.com/managed-services-market/requestsample

Competitive Landscape:

The competitive landscape of the market has been studied in the report with detailed profiles of the key players operating in the market.

- Accenture plc

- AT&T Inc.

- Capgemini SE

- Cisco Systems Inc.

- Dell Technologies Inc.

- Fujitsu Limited

- Infosys Limited

- International Business Machines Corporation

- Nokia Corporation

- Rackspace Technology Inc.

- Tata Consultancy Services Limited

- Telefonaktiebolaget LM Ericsson

- Verizon Communications Inc.

- Wipro Limited

Managed Services Market Report Segmentation:

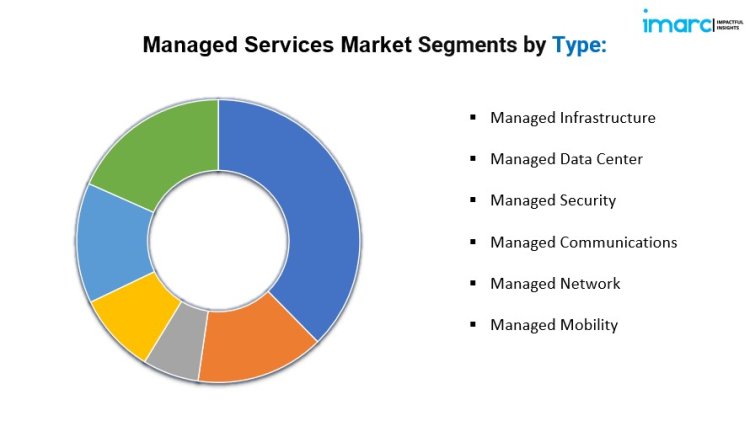

Breakup By Type:

- Managed Infrastructure

- Managed Data Center

- Managed Security

- Managed Communications

- Managed Network

- Managed Mobility

Managed infrastructure accounts for the majority of shares as businesses prioritize outsourcing complex IT infrastructure management for improved efficiency and cost savings.

Breakup By Deployment Mode:

- On-premises

- Cloud-based

On-premises dominate the market as many companies prefer greater control and security over their data and systems.

Breakup By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises represent the majority of shares due to their substantial IT needs and higher capacity to invest in comprehensive managed services.

Breakup By End Use:

- IT and Telecommunication

- BFSI

- Healthcare

- Entertainment and Media

- Retail

- Manufacturing

- Government

- Others

IT and telecommunication hold the majority of shares as these industries require extensive support for maintaining complex networks and systems.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America holds the leading position owing to the region's advanced technological adoption and strong presence of managed service providers.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=6158&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145