Malaysia Online Insurance Market to Exhibit a Remarkable CAGR of 2.05% by 2030, Size, Share, Trends, Key Drivers, Demand, Opportunity Analysis, and Competitive Outlook

Malaysia Online Insurance Market to Exhibit a Remarkable CAGR of 2.05% by 2030, Size, Share, Trends, Key Drivers, Demand, Opportunity Analysis, and Competitive Outlook

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

According to MarkNtel Advisors who is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. Recently released a report on Malaysia Online Insurance Market - Industry Trends and Forecast to 2030 and provides a comprehensive analysis of the current and future market conditions. The market research insights offered in this report enhance understanding of the market landscape, potential challenges, and strategies to establish a strong brand presence. With detailed market segmentation, in-depth analysis of key players, examination of consumer and supply chain trends, and exploration of new geographic markets, the insights presented in this report simplify the effective marketing of products and services.

Malaysia Online Insurance Market Analysis and Size

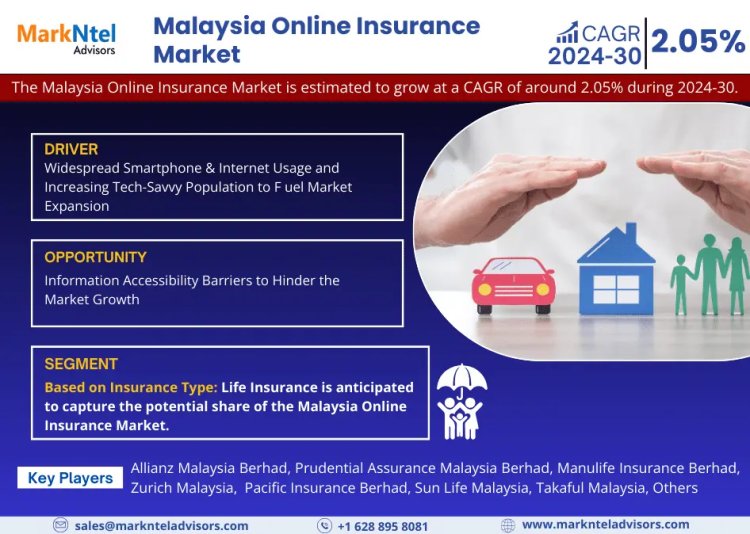

The Malaysia Online Insurance Market is estimated to grow at a CAGR of around 2.05% during the forecast period, i.e., 2024-30.

Get a Free Sample PDF Copy of this Report to understand structure of the complete report @ https://www.marknteladvisors.com/query/request-sample/malaysia-online-insurance-market.html

Some of the major players operating in the Malaysia Online Insurance Market are Allianz Malaysia Berhad, Prudential Assurance Malaysia Berhad, AIA Bhd., Manulife Insurance Berhad, Zurich Malaysia, Hong Leong Assurance Berhad, Pacific Insurance Berhad, Sun Life Malaysia, Takaful Malaysia, Generali Insurance Malaysia Berhad, Great Eastern Life Insurance (Malaysia) Berhad, and Others (Etiqua Insurance Berhad, AM Assurance, etc.

Malaysia Online Insurance Market Growth Driver:

Widespread Smartphone & Internet Usage and Increasing Tech-Savvy Population to Fuel Market Expansion – The widespread adoption of smartphones and easy access to the internet has been instrumental in shaping the Malaysia Online Insurance Market. The younger demographic, particularly Malaysians, is becoming more connected, turning online platforms into a convenient channel for insurance transactions and driving market growth. Additionally, the country's tech-savvy population, comfortable with digital tools and online transactions, has played a crucial role in the success of online insurance platforms. This inclination towards embracing technology has further heightened the demand for online insurance, contributing to the market's upward trajector.

Browse More About This Research Report @ https://www.marknteladvisors.com/research-library/malaysia-online-insurance-market.html

Market Segment and Geographical Analysis

By Insurance Type

- Life Insurance- (Market Size & Forecast 2019-2030, (USD Million)

- Health insurance- (Market Size & Forecast 2019-2030, (USD Million)

- Motor Insurance- (Market Size & Forecast 2019-2030, (USD Million)

- Home Insurance- (Market Size & Forecast 2019-2030, (USD Million)

- Others (Vehicle Insurance, Property Insurance, etc.)- (Market Size & Forecast 2019-2030, (USD Million)

By End User

- Individual Consumers- (Market Size & Forecast 2019-2030, (USD Million)

- Business Entities- (Market Size & Forecast 2019-2030, (USD Million)

- Transport & Logistics Companies - (Market Size & Forecast 2019-2030, (USD Million)

- Financial Institutions- (Market Size & Forecast 2019-2030, (USD Million)

- Others (Healthcare Providers, Government Entities, etc.)- (Market Size & Forecast 2019-2030, (USD Million)

By Enterprise Size

- Large Enterprises- (Market Size & Forecast 2019-2030, (USD Million)

- SMEs- (Market Size & Forecast 2019-2030, (USD Million)

By Region

- North

- South

- East

- Central

- Sarawak

- Sabah

Note - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Browse Trending Reports:

- https://network-30.mn.co/posts/64498067

- https://mejeyah4.widblog.com/84068788/gcc-energy-drinks-market-size-share-expansion-and-future-outlook-2030

- https://taxecure.mn.co/posts/64500950

- https://smush-please.mn.co/posts/64500956

- https://spider-web.mn.co/posts/64500977

Note: If you require specific information not covered in the current report, we can provide it through customized option

Why choose Us?

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

For Media Inquiries, Please Contact:

Call: +1 628 895 8081 | +91 120 4278433

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India