InsurTech Market Trends: Detailed Insights on Size, Share, and Growth Projections for 2030

InsurTech Market Trends: Detailed Insights on Size, Share, and Growth Projections for 2030

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

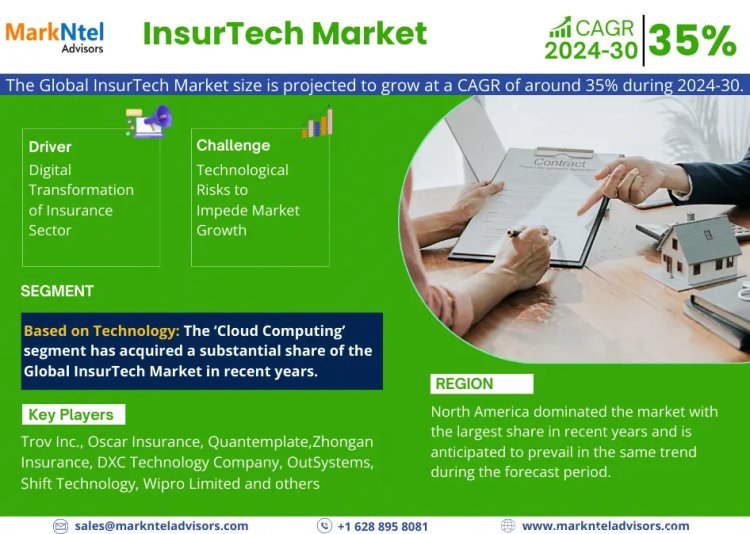

According to MarkNtel Advisors study the Global InsurTech Market size is projected to grow at a CAGR of around 35% during the forecast period, i.e., 2024-30.

Key Findings of the Study: InsurTech market

Global InsurTech Market Driver:

Digital Transformation of Insurance Sector – The rapidly changing business models, constant technological advancements in services & solutions, and increasing support from the governments of different countries are promoting digital transformation in the insurance industry. All these factors are propelling the demand for InsurTech solutions substantially and globally. It, in turn, is displaying an increasing adoption of these solutions among insurance companies to leverage their offerings & expand reachability across different regions worldwide, thereby driving the Global Insurtech Market in the coming years.

Access Free Sample Report - https://www.marknteladvisors.com/query/request-sample/global-insurtech-market.html

Global InsurTech Market Challenge:

Technological Risks to Impede Market Growth – Undoubtedly, technological hazards can provide obstacles for the Global InsurTech Industry. Technology is the engine of innovation in the insurance sector, but it also brings several dangers that require careful management. Cyberattacks target InsurTech companies because they manage enormous volumes of sensitive client data. Risks associated with data breaches, illegal access, and other cybersecurity issues can result in large-scale monetary losses, harm to one's reputation, and legal repercussions.

Furthermore, it can be difficult to integrate and apply new technology to current systems. The innovative technologies that InsurTech companies hope to deploy may not be readily compatible with the insurance industry's legacy systems. Delays, higher expenses, and interruptions to operations may result from this. Additionally, when it comes to software tools, cloud services, and data analytics platforms, among other technological solutions, InsurTech enterprises frequently depend on outside suppliers. Reliance on outside vendors exposes the InsurTech company to the danger of service interruptions, outages, or other problems that are not directly under its control. Therefore, all these factors may hinder the growth of the Global Insurtech Market in the coming years.

Scope of the Report and InsurTech Market Segmentation:

By Technology

- Block chain

- Cloud Computing

- Internet of Things (IoT)

- Machine Learning (ML)

- Artificial Intelligence (AI)

- Drones

The ‘Cloud Computing’ segment has acquired a substantial share of the Global InsurTech Market in recent years.

By Deployment Mode

- On-Premise

- Cloud

By Application

- Life and Accident Insurance

- Health and Medical Insurance

- P&C Insurance

- Commercial Insurance

- Insurance Administration and Risk Consulting

- Annuities

For more detailed information about the InsurTech market report, click here – https://www.marknteladvisors.com/research-library/global-insurtech-market.html

InsurTech Market Competitive Landscape

- Trov, Inc.

- Oscar Insurance

- Policy Bazaar

- Quantemplate

- Clover Health Insurance

- Tractable

- Anorak Technologies

- Majesco

- Cytora Ltd.

- Zhongan Insurance

InsurTech Market Development:

- In August 2023, DXC Technology Company, disclosed a new multi-year arrangement to provide end-to-end support for a component of AT&T's IT infrastructure operations. AT&T's midrange IT infrastructure, comprising enterprise compute, storage, backup, and recovery environments, will be managed by DXC. In addition, DXC will oversee the maintenance and design of the hardware in these settings, as well as the databases, storage, and systems.

Geographical Analysis:

By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

North America dominated the market with the largest share in recent years and is anticipated to prevail in the same trend during the forecast period.

Note: If you require specific information not covered in the current report, we can provide it through customized option

Why choose Us?

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

For Media Inquiries, Please Contact:

Call: +1 628 895 8081 | +91 120 4278433

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India