Insurtech Market Size, Trends, Scope, Outlook and Report 2025-2033

Insurtech Market Size, Trends, Scope, Outlook and Report 2025-2033

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Market Overview:

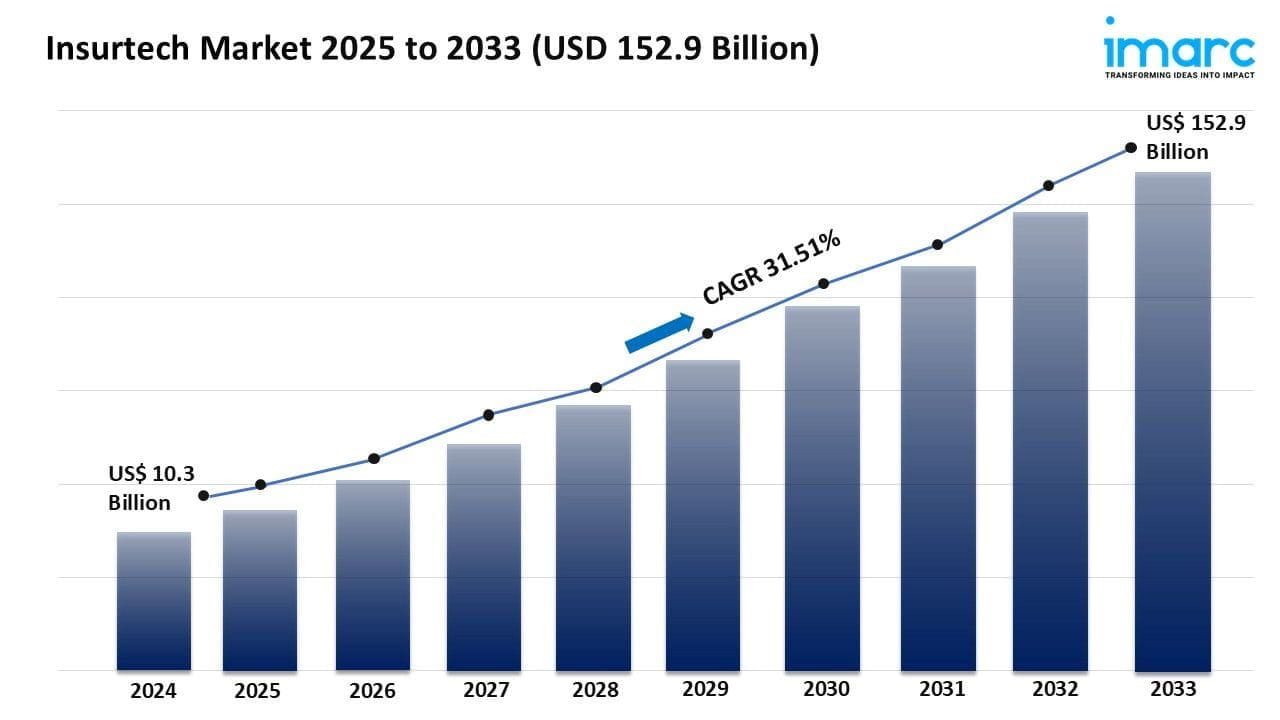

The Insurtech Market is experiencing rapid growth, driven by Emerging Markets Driving Global Expansion, Data-Driven Personalization and IoT Changing Insurance Models, and AI And Automation Improve Operations And Customer Service. According to IMARC Group's latest research publication, "Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033", The global insurtech market size was valued at USD 10.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 152.9 Billion by 2033, exhibiting a CAGR of 31.51% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/insurtech-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Factors Affecting the Growth of the Insurtech Industry:

-

Emerging Markets Driving Global Expansion:

The insurtech space is taking off globally and continued to build momentum in the Asia-Pacific region with India, China, and Southeast Asia seeing rapid development. Increased insurance penetration levels and digital infrastructure are contributing to this growth. The existing opportunities for growth and the much larger population that is still underinsured will continue to present opportunities for innovation. Recent funding rounds by regional insurtechs, including Finsall's estimated ₹15 crore investment in 2024, show growing confidence in the region. Europe also continues to build out its secondary markets with progressive regulatory reforms that enhance choice and competition and drive the interconnected insurtech world.

-

Data-Driven Personalization and IoT Changing Insurance Models:

The Internet of Things (IoT)—with examples like telematics and wearables—is changing how risk is assessed. IoT devices give us real-time visibility into behaviors that ultimately help source usage-based pricing. Vehicle telematics adjust auto insurance rates both affordably and dynamically - allowing premiums to be customized for every driver. The opportunity to use health wearables allows greater customization for wellness-linked life insurance products. Be prepared to be inundated with data! IoT data is forecasted to be 2.5 quintillion bytes every day. All this data has benefits to insurers, including better underwriting, reduced fraud and increasing efficiency of claims. In the end this allows the creation of highly customized products. This raises the bar on what is standard within the industry.

-

AI And Automation Improve Operations And Customer Service:

AI chatbots, automated claims processing, and blockchain smart contracts create savings of approximately 30-40% and efficiencies with every process, while predictive analytics provide insurers with a better risk management tool. Likewise, AI underwriting speeds up the issuance of quotes for consumers. Currently, over 25% of insurers have AI to personalize the insured's interaction. The direct impact of this technology and innovation is improvement in parametric insurance and on demand coverage. As a result, insurance is becoming accessible for more people and more profitable.

Explore full report with table of contents: https://www.imarcgroup.com/insurtech-market

Leading Companies Operating in the Global Insurtech Industry:

- Clover Health LLC

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Majesco (Aurum PropTech Limited)

- Oscar Insurance Corporation

- Quantemplate

- Shift Technology

- Travelers Companies, Inc.

- Wipro

- ZhongAn Online P&C Insurance Co. Ltd.

Insurtech Market Report Segmentation:

By Type:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

Based on the type, the market has been classified into auto, business, health, home, specialty, travel, and others.

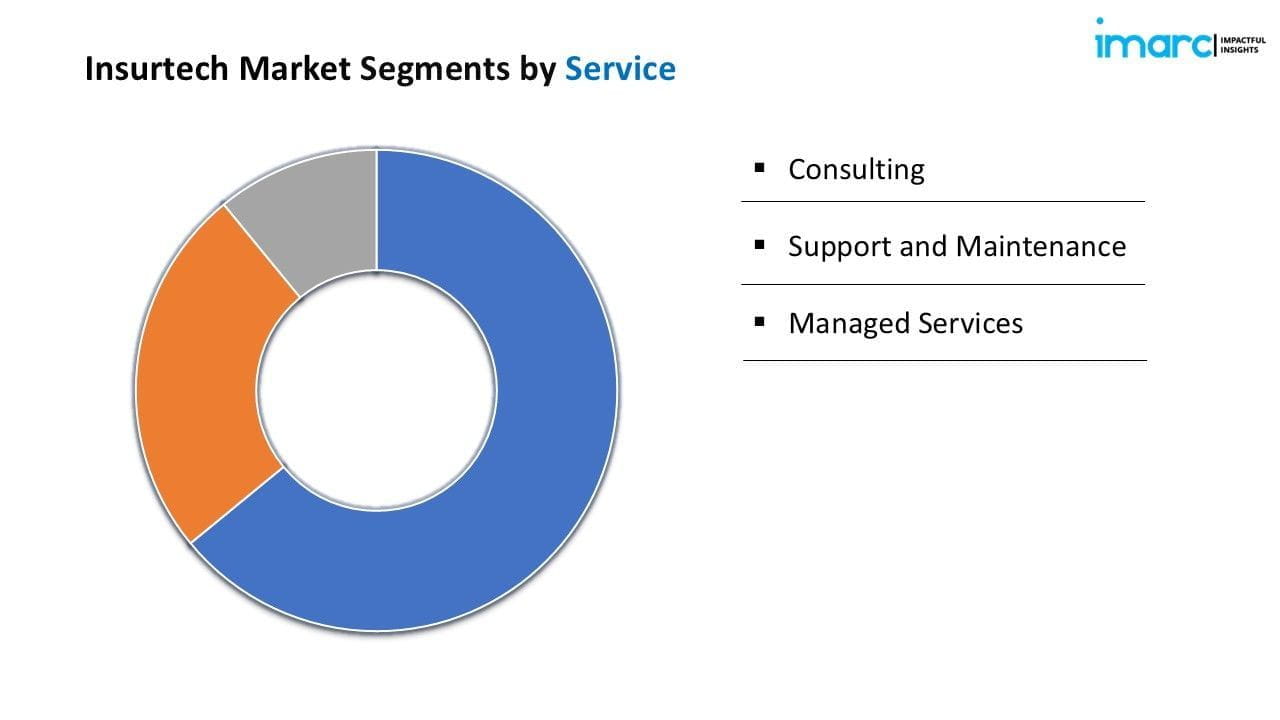

By Service:

- Consulting

- Support and Maintenance

- Managed Services

On the basis of the service, the market has been divided into consulting, support and maintenance, and managed services.

By Technology:

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

Cloud computing accounts for the largest market share due to its scalability, cost-efficiency, and ability to provide insurers with seamless access to data and applications, enabling streamlined operations and enhanced customer experiences.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America's dominance in the insurtech market is attributed to its robust technological infrastructure, high adoption rates of digital solutions, and well-established insurance industry, making it a fertile ground for the growth of insurtech companies.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

robbyrobinsons

robbyrobinsons