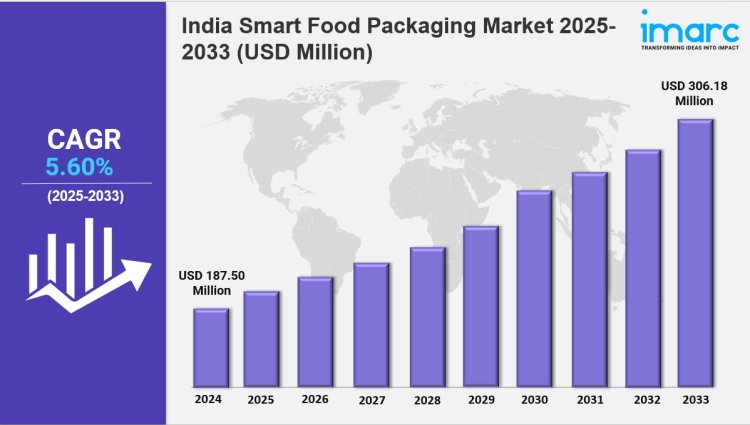

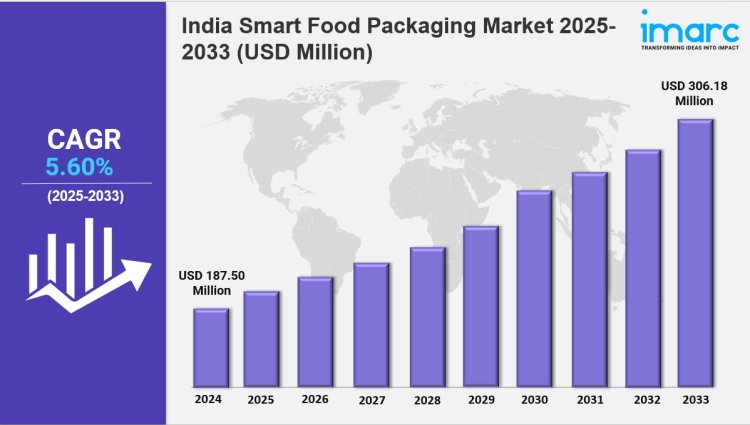

India Smart Food Packaging Market Size, Share, Growth and Report 2025-2033

The India Smart Food Packaging Market is changing quickly due to IoT technologies. Smart packaging with sensors, QR codes, and NFC tags is becoming popular. Consumers and manufacturers want real-time tracking of food quality, safety, and shelf life. These technologies provide full visibility in supply chains, which reduces waste and boosts transparency.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Market Overview 2025-2033

The India smart food packaging market size reached USD 187.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 306.18 Million by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. The market is growing due to increasing demand for food safety, rising consumer awareness, and advancements in packaging technology. Sustainability trends, regulatory support, and smart labeling innovations are key factors driving industry expansion.

Key Market Highlights:

✔️ Strong market growth driven by increasing demand for food safety and extended shelf life

✔️ Rising adoption of biodegradable, intelligent, and active packaging solutions

✔️ Expanding use of IoT and sensor-based technologies for real-time freshness monitoring

Request for a sample copy of the report: https://www.imarcgroup.com/india-smart-food-packaging-market/requestsample

India Smart Food Packaging Market Trends and Drivers:

The India Smart Food Packaging Market is changing quickly due to IoT technologies. Smart packaging with sensors, QR codes, and NFC tags is becoming popular. Consumers and manufacturers want real-time tracking of food quality, safety, and shelf life. These technologies provide full visibility in supply chains, which reduces waste and boosts transparency. In 2024, IoT-enabled packaging use grew, especially for perishables like dairy, meat, and fresh produce. Temperature and humidity sensors help keep these items stored correctly.

Startups and companies like EcoPack India and FreshTrak are working with tech firms to create affordable solutions for India’s complex logistics system. Still, high upfront costs and low digital literacy among small vendors slow down adoption. Sustainability is reshaping the India Smart Food Packaging Market as consumers and regulators push for eco-friendly alternatives to traditional plastics. Biodegradable materials like plant-based polymers, edible coatings, and compostable films are gaining prominence, driven by heightened environmental awareness and government initiatives such as the Plastic Waste Management Amendment Rules (2024).

Smart packaging designs now combine sustainability with functionality—for instance, TerraPack’s compostable pouches with embedded freshness indicators. However, scalability remains a hurdle due to limited raw material availability and higher production costs compared to conventional plastics. The India smart food packaging market share is expected to expand significantly as public-private partnerships and R&D investments drive innovation, positioning India as a leader in sustainable smart packaging solutions by the decade’s end.

Regulatory reforms are accelerating the adoption of smart food packaging in India. The Food Safety and Standards Authority of India (FSSAI) mandated stricter traceability protocols in 2024, requiring manufacturers to integrate tamper-evident seals and blockchain-enabled QR codes for real-time authentication. This move aims to curb counterfeit products and ensure compliance with hygiene standards, particularly in the aftermath of post-pandemic supply chain disruptions. Companies like SafeTrack and AgriSecure are leveraging blockchain to create immutable records of product journeys, from farm to fork.

Meanwhile, smart labels with multilingual information cater to India’s diverse linguistic landscape, enhancing consumer trust. While large corporations have swiftly adopted these technologies, SMEs face challenges due to budget constraints and technical complexities. To bridge this gap, the government launched subsidy programs in 2024, offering financial aid for IoT infrastructure and training. These regulatory tailwinds are expected to drive a 22% YoY growth in compliance-driven smart packaging solutions by 2027, further strengthening the India smart food packaging market share.

The India Smart Food Packaging Market is changing fast. It combines new technology, sustainability needs, and strict regulations. A major trend is hybrid packaging systems. These systems blend IoT technology with eco-friendly materials, appealing to both urban and rural customers. For example, SmartFresh offers solar-powered, temperature-controlled boxes. These boxes use biodegradable insulation to keep perishables fresh during delivery.

This solution is becoming popular in 2024 among e-commerce leaders like BigBasket and Blinkit. Another trend is the rise of direct-to-consumer (D2C) brands. These brands focus on smart packaging to stand out in busy markets. They use interactive QR codes to offer personalized nutrition tips and loyalty rewards. This approach fits well with India's digital-first consumers.

The market is seeing a rise in public-private collaborations. This is especially true after the 2024 regulatory changes aimed at standardizing smart packaging protocols and cutting costs. At the same time, startups are using AI for predictive analytics. This helps them optimize packaging designs based on local climate and consumption trends. As India aims to become a global leader in smart packaging innovation, it must balance affordability, scalability, and sustainability for lasting success.

India Smart Food Packaging Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

-

Active Packaging

-

Controlled Packaging

-

Modified Atmosphere Packaging

-

Others

Breakup by Material:

-

Plastic

-

Metal

-

Glass

-

Paper

-

Aluminium

Breakup by Region:

-

North India

-

South India

-

East India

-

West India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

imarc2024

imarc2024