How SharkShop Rebuilds Your Credit Score from ScratchHow SharkShop Rebuilds Your Credit Score from Scratch

How SharkShop Rebuilds Your Credit Score from ScratchHow SharkShop Rebuilds Your Credit Score from Scratch

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

How SharkShop Rebuilds Your Credit Score from ScratchHow SharkShop Rebuilds Your Credit Score from Scratch

Are you tired of being held back by a less-than-stellar credit score? Do you dream of unlocking the doors to better loan terms, lower interest rates, and financial freedom? Look no further! In this blog post, we’re diving into the innovative world of SharkShop.biz your ultimate partner in rebuilding your credit from scratch.

Whether you're starting over after setbacks or simply looking to boost your score for future opportunities, SharkShop is here to guide you every step of the way. Get ready to transform your financial future with actionable insights and proven strategies that will have lenders singing your praises in no time! Let’s embark on this journey together and discover how SharkShop can turn those dreams into reality!

Introduction to the Importance of Credit Score

Your credit score plays a crucial role in your financial life. It's more than just a number; it's a key that opens doors to better interest rates, loan approvals, and even housing options. Unfortunately, many people underestimate its importance until they face the consequences of having a low score. Whether you're recovering from past mistakes or simply looking to improve your financial standing, rebuilding your credit can seem like an overwhelming task.

Enter SharkShop.biz a game-changer in the world of credit repair. This innovative program is designed not only to help you understand your current situation but also to guide you step-by-step on the journey toward credit restoration. With tailored strategies and proven methods, SharkShop empowers you to take control of your finances and build a solid foundation for future growth. Let’s dive deeper into how this comprehensive approach works!

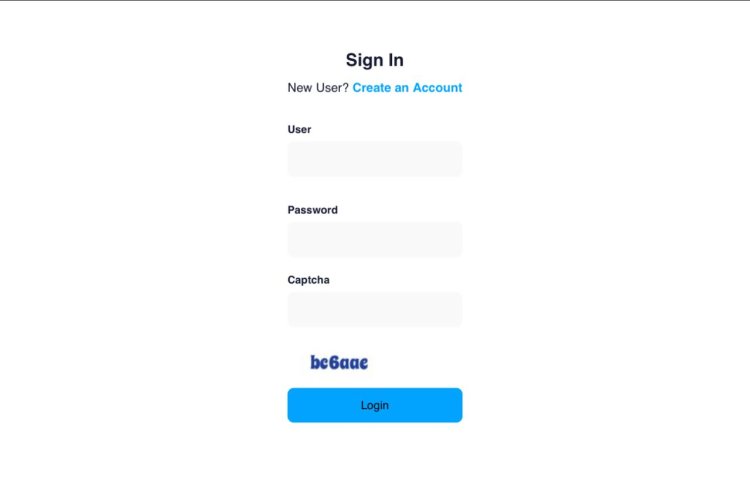

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding How Credit Scores are Calculated

Credit scores are a reflection of your financial behavior. They range from 300 to 850, with higher scores signaling better creditworthiness.

Several factors contribute to this score. Sharkshop Payment history holds the most weight, accounting for about 35%. Missing payments or defaulting can significantly hurt your score.

The second most important aspect is credit utilization, which makes up around 30% of your score. This measures how much of your available credit you're using. Keeping this ratio below 30% is ideal.

Length of credit history affects roughly 15% of the calculation. Older accounts show lenders that you have experience managing debt responsibly.

Lastly, new credit inquiries and types of credit mix together comprise the remaining percentage. Too many hard inquiries can be detrimental while having various types shows versatility in managing finances effectively. Understanding these components helps demystify the scoring process and empowers individuals to take control of their financial future.

The Negative Impact of a Low Credit Score

A low credit score can cast a long shadow over your financial life. It acts like a red flag for lenders, making it harder to secure loans or credit cards.

When you do get approved, the terms often come with higher interest rates. This means paying more in the long run for things like mortgages or car loans.

Renting an apartment can also become complicated. Many landlords check credit scores before approving tenants. A poor score might limit your options or lead to hefty security deposits.

Insurance premiums may rise as well. Some insurers consider your credit history when determining rates, which could translate into unexpected costs each month.

Furthermore, job prospects can be affected too; some employers check credit reports during the hiring process. It’s clear that neglecting your credit health can ripple through various aspects of life, creating obstacles where there should be opportunities.

Step-by-Step Guide on How SharkShop Rebuilds Your Credit Score

SharkShop offers a structured approach to rebuilding your credit score, starting with a thorough evaluation of your current financial situation. By analyzing your credit report, they identify areas that need immediate attention.

Next, SharkShop collaborates with you to create a tailored plan for improvement. This includes setting realistic goals and timelines based on your specific circumstances.

Disputing inaccuracies is another critical step. SharkShop assists in challenging errors on your credit report, ensuring that only accurate information impacts your score.

As you implement healthy financial habits—like timely bill payments and reducing debt—SharkShop provides valuable tools to help you stay on track. Their resources empower you to make informed decisions and build sustainable practices.

Regular progress tracking ensures that adjustments can be made as needed, keeping the momentum going toward achieving a better credit score. With these steps clearly defined, rebuilding becomes an attainable goal.

- Step 1: Evaluating Your Current Credit Situation

The first step in rebuilding your credit score with SharkShop involves a thorough evaluation of your current credit situation. This crucial assessment lays the groundwork for all future improvements.

Start by obtaining your credit reports from major bureaus. Reviewing these documents reveals vital information about your payment history, outstanding debts, and any accounts in collections.

Next, identify negative factors affecting your score. Are there late payments? High credit utilization? Understanding these aspects helps pinpoint where to focus efforts.

Additionally, check for inaccuracies on your report. Errors can significantly impact scores and may be contested through SharkShop login guidance.

This initial evaluation isn’t just about numbers; it’s an eye-opener that provides clarity on financial habits and areas needing attention. With this knowledge in hand, you’re ready to embark on a transformative journey toward better credit health.

- Step 2: Creating a Plan for Improvement

Creating a plan for improvement is essential in your credit rebuilding journey. This phase involves setting realistic goals tailored to your financial situation.

Start by identifying specific areas that need attention. Are there late payments dragging down your score? Or perhaps high credit utilization rates? Understanding these factors helps you focus on what matters most.

Next, establish a timeline for achieving these goals. Break them into smaller milestones to make the process more manageable and less overwhelming. For example, aim to reduce outstanding debts by a certain percentage each month.

Incorporate regular check-ins into your schedule. Evaluating progress reinforces commitment and allows adjustments if necessary. SharkShop provides tools that can help track every step you take toward improving your score, making it easier to stay motivated and accountable during this transformative journey.

- Step 3: Disputing Inaccurate Information on Your Credit Report

Disputing inaccurate information on your credit report is a crucial step in rebuilding your credit score. Errors can occur for various reasons—identity theft, clerical mistakes, or outdated accounts. These inaccuracies can negatively impact your financial health.

Start by obtaining a copy of your credit report from all three major bureaus: Experian, Equifax, and TransUnion. Review each detail carefully to identify any discrepancies that don't belong to you or are incorrectly reported.

Once you've found an error, gather supporting documents that prove the mistake. This could include payment confirmations or correspondence with creditors.

Next, file a dispute through the respective bureau’s online portal or via mail. Be clear and concise about what you're disputing and why it’s incorrect. The bureaus are required by law to investigate these claims within 30 days.

Taking action against inaccuracies not only improves your score but also empowers you as a consumer who understands their rights.

- Step 4: Implementing Healthy Financial Habits

Implementing healthy financial habits is crucial for rebuilding your credit score. Start by creating a budget that outlines your income and expenses. This will help you track spending and ensure you live within your means.

Next, prioritize paying bills on time. Set reminders or automate payments to avoid late fees, which can negatively affect your credit score. Consistency in timely payments builds trust with creditors.

Consider using credit responsibly. If you have a credit card, keep the balance low relative to its limit. Aim for below 30% utilization; this shows lenders you're managing credit wisely.

Lastly, regularly review your bank statements and transactions. This practice not only helps identify any discrepancies but also ensures that you're aware of where every dollar goes—keeping you financially accountable as you work toward improving your score.

- Step 5: Utilizing SharkShop's Tools and Resources

SharkShop cc offers a wealth of tools designed to empower you on your credit rebuilding journey. With an intuitive dashboard, users can easily track their progress and access key insights into their financial health.

One standout feature is the personalized budgeting tool. This resource helps you create a tailored budget that aligns with your income and expenses. By managing your finances effectively, you’ll naturally improve your credit standing over time.

Additionally, SharkShop provides educational resources such as webinars and articles. These materials cover everything from credit management strategies to understanding interest rates. Knowledge is power; by staying informed, you'll make smarter financial decisions.

Don’t overlook the community aspect either! Engaging in forums allows members to share experiences and tips while offering support during challenging times. With these tools at your disposal, you're not just rebuilding a score—you're building a stronger foundation for future success.

- Step 6: Tracking Progress and Adjusting as Needed

Tracking your progress is crucial on the journey to rebuilding your credit score. With SharkShop, you gain access to tools that help you monitor changes in real-time.

Regularly reviewing your credit report allows you to see how each step contributes to improvement. It’s not just about numbers; it's about understanding what influences those numbers.

If certain strategies aren’t yielding results, don’t hesitate to adjust your approach. Flexibility is key. SharkShop encourages users to reassess their plans periodically.

Whether it’s increasing payments or disputing errors again, staying proactive can make all the difference. Each small adjustment can lead to significant gains over time.

Celebrate milestones along the way too! Recognizing improvements helps maintain motivation and reinforces positive financial habits for the long haul.

Success Stories from SharkShop

Countless individuals have transformed their financial futures through the innovative program offered by SharkShop.biz. From those who felt trapped by overwhelming debt to others who believed they could never achieve a respectable credit score, SharkShop has become a beacon of hope.

Take Sarah, for example. After facing unexpected medical bills and falling behind on payments, her credit score plummeted to an all-time low. With guidance from SharkShop, she followed each step meticulously. Within months, not only did Sarah manage to dispute incorrect entries on her credit report, but she also built healthier spending habits that reinforced her progress.

Then there’s Mark, whose journey began with skepticism about whether he could ever rebuild his credit after several setbacks in life. Through personalized plans created by the experts at SharkShop and access to invaluable resources tailored just for him, Mark saw tangible results within weeks. His newfound understanding of finance helped him secure better loan terms and even land his dream home.

These success stories are just glimpses into what many experience when they commit to the structured support provided by SharkShop. Each person carries their unique challenges yet shares one common thread: determination paired with effective tools can lead to remarkable transformations in one’s financial health.

The road to rebuilding your credit may seem daunting at first glance; however, with programs like SharkShop paving the way forward, achieving your financial goals becomes an attainable reality for everyone willing to take that crucial first step toward change.