How Much Money Can You Send with Venmo After Verification?

Understanding how much money can you send on Venmo is essential for managing your finances and avoiding transaction issues. In this guide, we break down the Venmo transfer limits, how to increase them, and how they vary based on account verification status.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Venmo is one of the most popular mobile payment apps in the United States, allowing users to send and receive money quickly and easily. Whether you're splitting a dinner bill or paying your rent, understanding how much money can you send on Venmo is essential for managing your finances and avoiding transaction issues. In this guide, we break down the Venmo transfer limits, how to increase them, and how they vary based on account verification status.

How Much Money Can You Send on Venmo?

The amount of money you can send depends on whether your account is verified or unverified.

- Unverified Accounts: The sending limit is $299.99 per week. This includes all payments made through the app, whether to individuals or businesses.

- Verified Accounts: Once you complete Venmo’s identity verification, your weekly limit increases to $4,999.99 for person-to-person payments.

So, if you're wondering how much can I send on Venmo, the answer greatly depends on whether your account has been verified.

How Much Money Can You Send with Venmo After Verification?

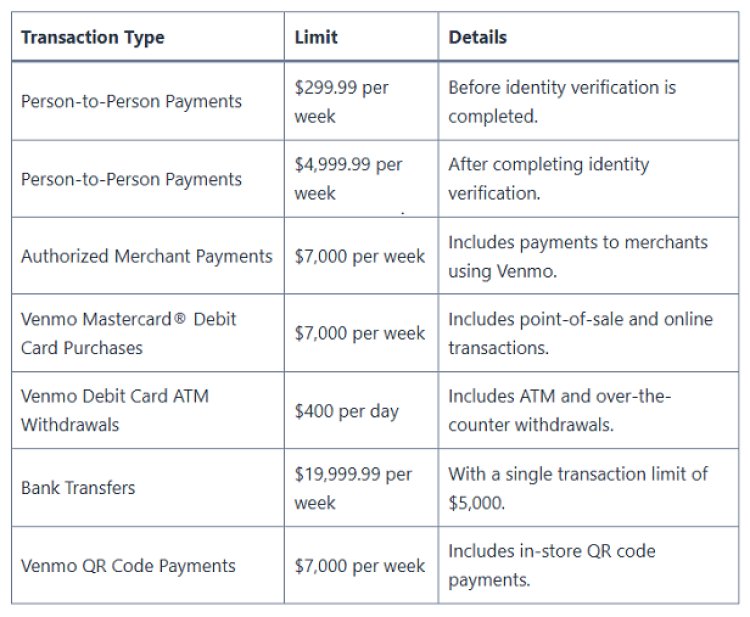

Once your identity is confirmed, your account enjoys significantly higher limits. The complete breakdown for verified accounts is as follows:

- Person-to-Person Payments: Up to $4,999.99 per week

- Authorized Merchant Payments: Up to $6,999.99 per week

- Combined Weekly Limit: A total of $6,999.99, which includes all types of transactions (personal and merchant)

Therefore, knowing how much money can you send with Venmo allows you to plan larger payments accordingly, whether to friends, family, or service providers.

How Much Can You Send Through Venmo Daily and Weekly?

Venmo does not impose strict daily sending limits, but it operates on a rolling weekly basis. That means your available limit refreshes one week after a transaction is made, not at the start of each calendar week.

Here’s a quick summary:

- Unverified Users: Up to $299.99 per week

- Verified Users: Up to $4,999.99 per week for sending money to people

When asking how much can you send through Venmo, it’s vital to check your transaction history and timing, especially if you're close to your limit.

How Much Can You Send via Venmo for Business Transactions?

Business profiles on Venmo have their own limits, based on account activity and verification:

- Receiving Limit for Business Profiles: Up to $24,999.99 per week

- Sending Limits: Similar to personal accounts, but may vary with account standing

If you're operating as a business or freelancer, it's crucial to know how much can you send via Venmo, as exceeding limits may delay transactions or trigger compliance reviews.

How Much Can You Transfer on Venmo to Bank Accounts?

Transferring money from Venmo to your bank account also comes with limits:

- Standard Bank Transfers (1–3 business days): No fee, up to your Venmo balance

- Instant Transfers: 1.75% fee (min $0.25, max $25), limit is $100,000 per transfer

Wondering how much can you transfer on Venmo to your bank? You can move large amounts as long as they are within the transfer cap and your account has sufficient balance.

How Much Can You Transfer With Venmo Between Accounts?

If you’re sending funds between personal and business profiles, or to friends and family, the same weekly limits apply:

- Verified users: $4,999.99 per week

- Unverified users: $299.99 per week

Therefore, how much can you transfer with Venmo directly affects how you manage larger recurring payments like rent, bills, or shared expenses.

How to Increase Your Venmo Transfer Limit

To gain access to higher limits, you need to verify your identity within the Venmo app:

- Open the app and go to Settings.

- Tap Identity Verification.

- Provide your legal name, address, date of birth, and SSN.

- Submit and wait for confirmation (usually immediate or within 3 business days).

Verification unlocks greater flexibility, which is essential if you're frequently sending money or managing large transactions.

Conclusion

Venmo is a powerful tool for digital payments, but it comes with limits designed to ensure security and compliance. Whether you're curious about how much can I send on Venmo or looking to boost your sending power, verifying your identity is key. From peer-to-peer payments to business transactions and bank transfers, knowing how much money can you send on Venmo enables you to make informed financial decisions without interruptions.

FAQs

Q: What is the weekly limit for sending money on Venmo?

A: Verified users can send up to $4,999.99 per week, while unverified users are capped at $299.99.

Q: Does Venmo have a daily sending limit?

A: No strict daily limit exists, but you are bound by your rolling weekly limit.

Q: How do I increase my Venmo send limit?

A: You must verify your identity in the app to access higher transfer limits.

Q: Can I send more than $5,000 on Venmo?

A: Not in a single week for personal payments. You would need to split the payment across two weeks or use other methods.

Q: How much can I transfer from Venmo to my bank?

A: Up to your available balance for standard transfers, or $100,000 per transfer for Instant Transfers.

Q: Are there fees for transferring money on Venmo?

A: No fee for standard transfers. Instant Transfers cost 1.75%, and credit card payments incur a 3% fee.