How Are Bitcoin Automatic Payments Transforming Global Commerce?

Discover how Bitcoin automatic payments enhance global commerce by reducing costs, increasing security, and enabling seamless international transactions for businesses.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

The global financial landscape has seen significant transformations in recent years, largely due to the rise of cryptocurrencies like Bitcoin. Bitcoin, being the first decentralized digital currency, has introduced new methods of conducting financial transactions. As businesses and consumers alike explore the potential of Bitcoin, one notable development has been the rise of Bitcoin automatic payment systems, a method that offers unparalleled convenience, security, and global access. Platforms such as Savastan0 have taken a lead role in this space, and their integration into digital transactions is changing the way businesses operate worldwide.

In this article, we will explore the intricacies of Bitcoin automatic payments, their benefits, challenges, and their potential role in the future of commerce.

What Are Bitcoin Automatic Payments?

Bitcoin automatic payments refer to the use of blockchain technology to automate financial transactions using Bitcoin. Much like automated payments in traditional banking systems, Bitcoin automatic payments allow users to schedule regular payments without requiring manual intervention. However, Bitcoin automatic payments operate outside the boundaries of traditional financial systems, utilizing the decentralized nature of blockchain to make transactions secure, transparent, and efficient.

For instance, with Bitcoin automatic payments, a business can schedule recurring payments for services, salaries, or subscriptions, all handled seamlessly through a cryptocurrency wallet. Unlike traditional automated payments that rely on banks or financial institutions, Bitcoin transactions occur directly between the parties involved, thanks to decentralized blockchain technology.

Benefits of Bitcoin Automatic Payments

There are several key benefits to using Bitcoin automatic payments, which are drawing the attention of businesses and individuals alike. Let’s examine the major advantages:

1. Lower Transaction Fees

Traditional payment systems often involve high fees, particularly for cross-border transactions. Banks and payment processors charge significant amounts for currency conversions, transaction processing, and international payments. Bitcoin automatic payments eliminate these intermediaries, thereby reducing the fees associated with transactions. This makes Bitcoin especially appealing to businesses looking to cut down on operational costs, particularly when dealing with international partners or customers.

2. Global Accessibility

Bitcoin is a borderless currency, meaning it can be sent and received anywhere in the world without requiring bank accounts, currency exchanges, or other restrictions typically imposed by fiat currencies. Bitcoin automatic payments allow businesses to set up recurring international transactions without worrying about delays, currency fluctuations, or compliance with different banking regulations.

This level of global accessibility makes Bitcoin automatic payments particularly useful for companies operating in diverse geographical markets, offering them a seamless and unified way of managing payments across borders.

3. Decentralized Control

With traditional financial systems, users are at the mercy of banks and other institutions. These centralized entities control the payment process, and they can restrict transactions or charge fees at their discretion. With Bitcoin automatic payments, control is shifted directly to the user. The decentralized nature of Bitcoin means that users no longer have to depend on intermediaries to execute transactions. The use of blockchain ensures that transactions occur directly between the sender and the receiver, with no third party involved.

4. Security and Transparency

Bitcoin payments are encrypted and recorded on the blockchain, a public ledger that keeps track of every transaction ever made. This ledger is transparent and immutable, meaning that once a transaction has been recorded, it cannot be altered or tampered with. Bitcoin automatic payments benefit from this security and transparency, providing businesses and individuals with the assurance that their transactions are safe from fraud or unauthorized changes.

Furthermore, users can verify payments and view the transaction history easily, adding an extra layer of accountability to Bitcoin automatic payment systems.

5. Increased Privacy

Privacy is another significant benefit offered by Bitcoin automatic payments. Traditional banking systems require users to disclose personal information when setting up automated payments, which can be a concern for privacy-conscious individuals and businesses. Bitcoin payments, on the other hand, do not require users to disclose sensitive personal data. Transactions occur between digital wallets, and while the blockchain is publicly visible, the identities of the users behind the wallets are not easily traceable, offering enhanced privacy and anonymity.

Challenges of Bitcoin Automatic Payments

While Bitcoin automatic payments present numerous benefits, there are also some challenges associated with their use:

1. Price Volatility

One of the most significant issues associated with Bitcoin is its volatility. The value of Bitcoin can fluctuate wildly in a short period of time. For businesses relying on Bitcoin automatic payments, this volatility can be problematic. For example, if a company sets up a recurring payment to a service provider in Bitcoin, and the value of Bitcoin drops significantly before the payment is processed, the business may find itself paying much more than expected in fiat value.

While some businesses may choose to mitigate this risk by converting Bitcoin to stablecoins (cryptocurrencies pegged to a stable asset like the US dollar), volatility remains a challenge for widespread adoption.

2. Regulatory Uncertainty

Cryptocurrency regulations vary from country to country, and there is still a great deal of uncertainty around how Bitcoin and other cryptocurrencies will be regulated in the future. Some governments have adopted a friendly approach to cryptocurrency, while others have imposed strict regulations or outright bans. For businesses operating in multiple countries, navigating this patchwork of regulations can be a challenge, especially when using Bitcoin automatic payments.

Moreover, if new regulations are imposed, they could affect the ability of businesses to use Bitcoin automatic payment systems, creating uncertainty for long-term adoption.

3. Technical Complexity

Although Bitcoin automatic payments offer numerous advantages, setting up such a system requires some level of technical knowledge. Users must be familiar with cryptocurrency wallets, blockchain transactions, and sometimes smart contracts. For individuals and businesses unfamiliar with these technologies, the process can be intimidating.

That said, many platforms are working to simplify the process of setting up Bitcoin automatic payments, making it easier for non-technical users to take advantage of this technology.

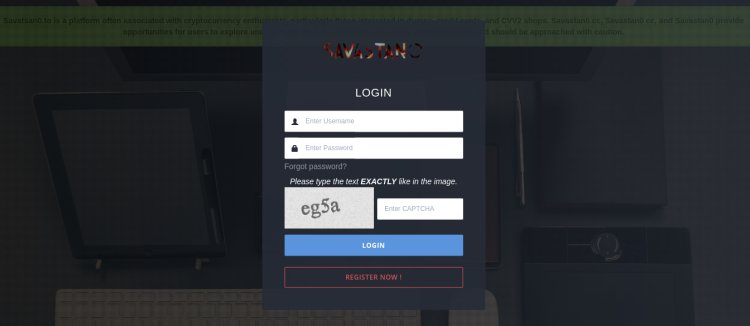

Bitcoin Automatic Payments and Savastan0

In recent years, platforms like Savastan0 have played a key role in advancing the adoption of Bitcoin automatic payments. These platforms offer intuitive tools that allow users to schedule, manage, and execute automatic Bitcoin payments without requiring deep technical expertise.

Savastan0 focuses on providing efficient and secure solutions for both individuals and businesses looking to integrate cryptocurrency payments into their operations. By simplifying the user experience, these platforms are helping to drive the adoption of Bitcoin automatic payments across a wide range of industries.

As these solutions become more accessible, it’s likely that more businesses will adopt Bitcoin automatic payments to reduce transaction costs, increase efficiency, and take advantage of the benefits offered by blockchain technology.

The Future of Bitcoin Automatic Payments

The future of Bitcoin automatic payments looks promising, particularly as technology continues to evolve and more businesses recognize the advantages of cryptocurrency. Here are some potential trends we might see in the future:

1. Integration with Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. By integrating Bitcoin automatic payments with smart contracts, businesses can create even more efficient and secure systems for managing transactions. For example, a smart contract could automatically release payments when certain conditions are met, removing the need for manual oversight.

2. Adoption by Mainstream Businesses

As more large corporations begin to accept Bitcoin as a payment method, we may see widespread adoption of Bitcoin automatic payments. This could be particularly beneficial for subscription-based services, which could automate recurring payments for their users using Bitcoin.

3. Increased Stability

While Bitcoin is currently known for its price volatility, the market may stabilize as adoption increases and more stablecoins are introduced. A more stable Bitcoin market would make automatic payments more predictable and reliable for businesses.

Conclusion

Bitcoin automatic payments represent a major shift in the way businesses and individuals handle financial transactions. By offering lower fees, greater security, and global accessibility, they provide a compelling alternative to traditional payment systems. While challenges such as volatility and regulatory uncertainty remain, the future looks bright for Bitcoin automatic payments as more platforms like Savastan0 continue to innovate and simplify the process.

As the world continues to embrace digital currencies, Bitcoin automatic payments could very well become a standard method of conducting transactions in the global marketplace, transforming the way commerce operates on a fundamental level.