GCC Financial Cards & Payments Market Trends: Detailed Insights on Size, Share, and Growth Projections for 2030

GCC Financial Cards & Payments Market Trends: Detailed Insights on Size, Share, and Growth Projections for 2030

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

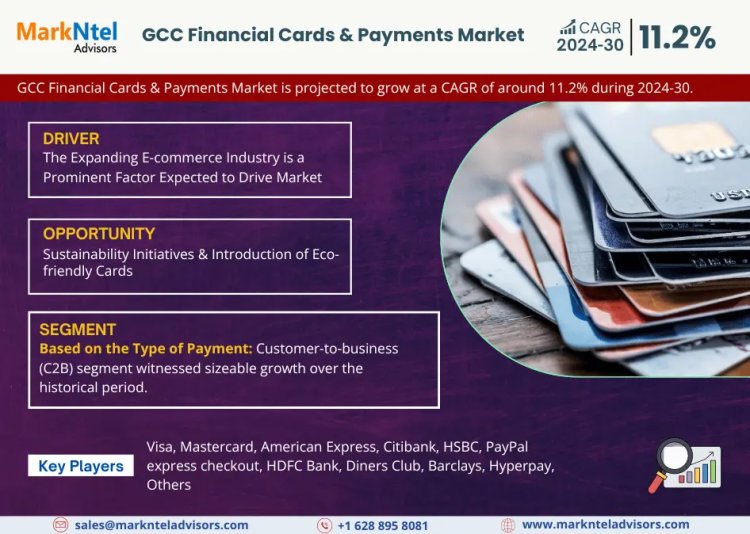

According to MarkNtel Advisors study the GCC Financial Cards & Payments Market is projected to grow at a CAGR of around 11.2% during the forecast period, i.e., 2024-30.

Access Free Sample Report - https://www.marknteladvisors.com/query/request-sample/gcc-financial-cards-payments-market.html

Key Findings of the Study: GCC Financial Cards & Payments market

GCC Financial Cards & Payments Market Driver:

Expanding E-commerce Industry – The growing e-commerce industry across the GCC region has well-supported the Financial Cards & Payments Market over the historical years. The countries, such as the UAE, Saudi Arabia, Qatar, etc., have witnessed a significant surge in online retail sales due to high investments by global retail players in the lucrative market. The countries, including the UAE, Qatar, Kuwait, and Bahrain have almost 100% of the population with internet and mobile phone access.

Due to this, the transactional volume of payments made via financial cards, such as debit cards, prepaid cards, credit cards, etc., has increased considerably. Moreover, the Dubai Chamber of Commerce and Industry forecasts e-commerce to generate USD8 billion in sales by the year 2025. Hence, it is expected that the ever-growing e-commerce market in the region will increase the demand for financial cards and payments in the forecast years.

GCC Financial Cards & Payments Market Opportunity:

Sustainability Initiatives & Introduction of Eco-friendly Cards – As nowadays, sustainability is becoming a priority worldwide, and many of the regions or regional countries are focusing on reducing the usage of things that emit carbon emissions. Similarly, in the GCC region governments & other businesses are taking several initiatives to reduce carbon footprints. As part of the sustainability efforts, banks are providing eco-friendly cards made of recycled materials & promoting paperless statements & digital receipts. Hence, this action underlines the dynamic nature of the GCC Financial Cards & Payments Market, further creating an opportunistic arena.

For more detailed information about the GCC Financial Cards & Payments market report, click here – https://www.marknteladvisors.com/research-library/gcc-financial-cards-payments-market.html

Scope of the Report and GCC Financial Cards & Payments Market Segmentation:

By Type of Card

- Credit Card

- Debit Card

- Charge Card

- Prepaid Card

By Type of Payments

- B2B

- B2C

- C2C

- C2B

- E-Commerce Shopping

- Payments at POS Terminals

- Others

Customer-to-business (C2B) segment witnessed sizeable growth over the historical period.

By Type of Transactions

- Domestic

- Foreign

By Card Issuing Institution

- Banking

- Non-Banking

GCC Financial Cards & Payments Market Competitive Landscape

- Visa

- Mastercard

- American Express

- Citibank

- HSBC

- PayPal express checkout

- HDFC Bank

- Diners Club

- Barclays

- Hyperpay

- Others

Geographical Analysis:

By Country

- Saudi Arabia

- The UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Note: If you require specific information not covered in the current report, we can provide it through customized option

Why choose Us?

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

For Media Inquiries, Please Contact:

Call: +1 628 895 8081 | +91 120 4278433

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India