Europe Beer Market Size, Share, Growth & Outlook 2033

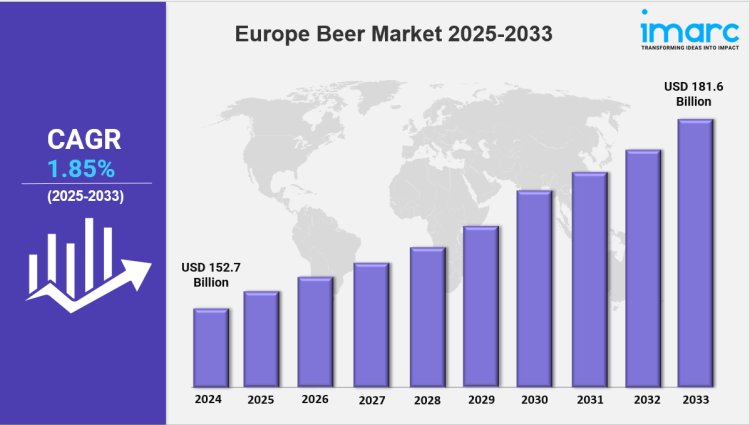

The Europe beer market size was valued at USD 152.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 181.6 Billion by 2033, exhibiting a CAGR of 1.85% from 2025-2033.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Market Overview 2025-2033

The Europe beer market size was valued at USD 152.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 181.6 Billion by 2033, exhibiting a CAGR of 1.85% from 2025-2033. The market is expanding due to rising consumer demand, craft beer trends, and premium product innovations. Sustainability initiatives, changing preferences, and technological advancements are driving growth, making it a dynamic and competitive industry.

Key Market Highlights:

✔️ Steady market growth driven by rising demand for craft, premium, and low-alcohol beers

✔️ Increasing consumer preference for sustainable and locally brewed beer options

✔️ Expanding distribution through e-commerce, breweries, and specialty retail stores

Request for a sample copy of the report: https://www.imarcgroup.com/europe-beer-market/requestsample

Europe Beer Market Trends and Drivers:

The European beer market is going through a major shift as drinkers move away from traditional mass-market brews and lean more toward craft, premium, and health-conscious options. In 2024, craft beer sales jumped by 12%, showing that even with rising production costs and supply chain hiccups, people are still willing to pay for quality. Countries like Germany, the UK, and Belgium are leading this change, with more consumers choosing local, small-batch beers that offer unique flavors and a personal touch. This evolving taste is having a real impact on the Europe beer industry share, pushing big-name brewers to stay relevant by either snapping up indie brands or launching their own premium lines.

But it’s not all smooth sailing. The industry is up against rising costs for ingredients and energy, stricter advertising rules—especially in Nordic countries—and mounting pressure to go green. In response, more than 60% of breweries in Europe are stepping up with eco-friendly practices. These include everything from energy-saving brewing systems and sustainable ingredient sourcing to serious waste-reduction efforts. Carlsberg’s “Together Towards Zero” plan, which aims to hit carbon neutrality by 2040, is just one example of how committed major players are to long-term sustainability goals in the European beer market.

Health trends are also reshaping what’s in the bottle. Sales of low- and no-alcohol beers rose 18% in 2024, especially in countries like Spain and the Netherlands. Heineken has reported that nearly a third of its regional offerings are now alcohol-free. To encourage this trend, the EU introduced tax breaks for beers under 3.5% ABV, giving breweries a solid reason to create lighter, more wellness-friendly options—further fueling Europe beer market demand.

While large brewing corporations still dominate in scale and reach, smaller breweries are carving out space by focusing on innovation and sustainability. Many independents are using recyclable packaging, solar or wind power, and water-saving technology to cut their environmental impact. With the EU banning single-use plastics, some major brewers like AB InBev are also testing out biodegradable packaging. Still, consumers are becoming more cautious about greenwashing, so brands need to back up their eco-claims with real proof and transparency.

One thing that sets the European beer market apart is its blend of old and new. While craft and premium labels often stick to time-honored brewing methods, there’s also a rise in alcohol-free and “functional” beers made with ingredients like adaptogens, vitamins, or botanicals. Even tiny microbreweries are getting into the low-alcohol space to cater to younger, more health-aware drinkers.

Tastes still vary widely across the continent. Southern Europe continues to favor light, refreshing lagers, while Northern regions like Denmark and Finland are seeing more interest in wellness-based brews. Technology is also changing how people buy beer—subscription boxes and online orders rose 22% in 2024, although local pubs and taprooms are still key to building brand loyalty and community ties.

Looking ahead, the outlook for the European beer market is bright. Brewers who adapt to changing preferences, control costs, and invest in sustainability will be in the best position to thrive. As trends like alcohol-free, eco-conscious, and premium beers gain traction, and as younger consumers seek both authenticity and innovation, the market is set for continued growth. For those ready to evolve with their audience, the future looks both refreshing and full of opportunity.

Europe Beer Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Analysis by Product Type:

-

Standard Lager

-

Premium Lager

-

Specialty Beer

-

Others

Analysis by Packaging:

-

Glass

-

PET Bottle

-

Metal Can

-

Others

Analysis by Production:

-

Macro-Brewery

-

Micro-Brewery

-

Others

Analysis by Alcohol Content:

-

High

-

Low

-

Alcohol-Free

Analysis by Flavor:

-

Flavored

-

Unflavored

Analysis by Distribution Channel:

-

Supermarkets and Hypermarkets

-

On-Trades

-

Specialty Stores

-

Convenience Stores

-

Others

Country Analysis:

-

Germany

-

France

-

United Kingdom

-

Italy

-

Spain

-

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

imarc2024

imarc2024