Cement Price Today | Chart & Forecast 2025

Several important factors are shaping cement prices in 2025, leading to both regional volatility and overall price trends

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

Cement Prices in North America – Q1 2025 Breakdown

Cement Prices in the United States:

|

Product |

Category |

Price |

|

Cement |

Chemical & Materials |

US$ 93/MT |

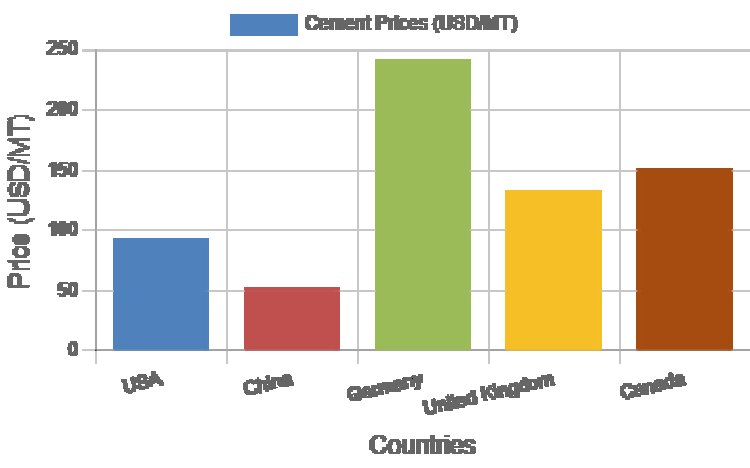

In March 2025, cement prices in the USA rose to 93 USD/MT, as shown in the Cement Price Chart, primarily due to increased demand from the housing sector and major infrastructure projects. This upward trend was further supported by significant federal and state investments, which boosted overall construction activity and contributed to higher cement prices.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/cement-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Cement Prices in China – Q1 2025 Breakdown

Cement Prices in China:

|

Product |

Category |

Price |

|

Cement |

Chemical & Materials |

US$ 53/MT |

In March 2025, the Cement Price Index in China reflected a price of 53 USD/MT, with fluctuations largely attributed to declining real estate demand and persistent overcapacity in the cement industry. These factors placed downward pressure on prices, highlighting the ongoing challenges faced by Chinese cement producers in balancing supply and demand.

Regional Analysis: The price analysis can be extended to provide detailed Cement price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries.

Cement Prices in Europe – Q1 2025 Breakdown

Cement Prices in Germany:

|

Product |

Category |

Price |

|

Cement |

Others |

US$ 242/MT |

In March 2025, the Cement Price Index in Germany reflected a price of 242 USD/MT, driven higher by increased feedstock costs and a contracting construction sector facing inflation, high interest rates, and economic uncertainty. These factors combined to elevate production expenses and limit new projects, significantly impacting cement pricing trends in the country.

Regional Analysis: The price analysis can be expanded to include detailed Cement price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Cement Prices in Europe – Q1 2025 Breakdown

Cement Prices in United Kingdom:

|

Product |

Category |

Price |

|

Cement |

Others |

US$ 133/MT |

During Q1 2025, the UK witnessed a decline in cement prices, largely due to reduced demand from the brewing and distilling sectors. Maintenance shutdowns and shifting consumer preferences led to lower consumption of malting cement, putting downward pressure on market rates. This trend is clearly reflected in the Cement Price Chart, which shows a noticeable dip during this period, highlighting the sector’s influence on overall pricing dynamics.

Regional Analysis: The price analysis can be expanded to include detailed Cement price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Cement Prices in North America – Q1 2025 Breakdown

Cement Prices in Canada:

|

Product |

Category |

Price |

|

Cement |

Chemical & Materials |

US$ 151/MT |

In Q1 2025, the Cement Price Index reflected notable trends in Canada and the UK. Canada’s cement prices peaked at 151 USD/MT in March, while the UK experienced fluctuations driven by reduced demand for heavy building materials, trade disruptions, and increasing production costs. These factors collectively influenced overall market volatility, as seen in the shifting Cement Price Index during this period.

Key Factors Influencing Cement Prices in 2025

Several important factors are shaping cement prices in 2025, leading to both regional volatility and overall price trends:

Government Infrastructure Spending: Increased investment in infrastructure projects is boosting demand for cement, supporting price growth in many regions.

Construction Activity: Growth in residential and commercial construction, especially in urban areas, is driving higher cement consumption and influencing price movements.

Input and Energy Costs: Elevated costs for raw materials like coal and natural gas are raising production expenses, prompting cement manufacturers to adjust prices.

Regional Supply and Demand Dynamics: Price trends vary by region, with some markets experiencing steady demand and price increases, while others see declines due to subdued construction activity or industry overcapacity.

Market Competition and Capacity Additions: New production capacity and competitive pressures can lead to price corrections or limit the sustainability of price hikes if demand growth does not keep pace.

Seasonal and Geopolitical Factors: Weather events, seasonal construction cycles, and geopolitical developments can disrupt supply chains and construction schedules, impacting both demand and pricing.

Overall, cement prices in 2025 are being shaped by a combination of strong infrastructure demand, fluctuating input costs, regional market conditions, and broader economic and geopolitical influences.

FAQs on Cement Price Trend & Forecast:

What factors are driving recent changes in cement prices globally?

Recent fluctuations in cement prices are driven by factors such as demand shifts in construction and infrastructure sectors, energy cost variations, supply chain disruptions, and government policies on production and tariffs. Seasonal trends and regional market dynamics also play a crucial role.

How do energy costs impact cement prices?

Energy costs significantly affect cement production expenses since cement manufacturing is energy intensive. Rising fuel and electricity prices increase operational costs, leading to higher cement prices, while lower energy costs can ease price pressure.

What does the Cement Price Chart indicate about market trends?

The Cement Price Chart visually represents historical and current price movements, highlighting periods of growth, decline, or stability. It helps stakeholders understand market cycles, forecast demand, and make informed purchasing or investment decisions.

How is oversupply influencing cement prices in certain regions?

Oversupply occurs when production exceeds demand, causing inventory build-up and downward price pressure. In markets with weak construction activity, such as Germany in Q4 2024, oversupply has led to significant price declines.

What is the outlook for cement prices in 2025?

Cement Price Forecasts for 2025 suggest mixed trends. While some regions expect price stabilization due to production cutbacks and easing interest rates, others may face volatility driven by fluctuating demand and ongoing supply chain challenges. Monitoring regional economic indicators remains essential.

Key Coverage:

- Market Analysis

- Market Breakup by Region

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Price Analysis

- Spot Prices by Major Ports

- Price Breakup

- Price Trends by Region

- Factors influencing the Price Trends

- Market Drivers, Restraints, and Opportunities

- Competitive Landscape

- Recent Developments

- Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, “Cement Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition,” presents a detailed analysis of Cement price trend, offering key insights into global Cement market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Cement demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

stephenthomas

stephenthomas