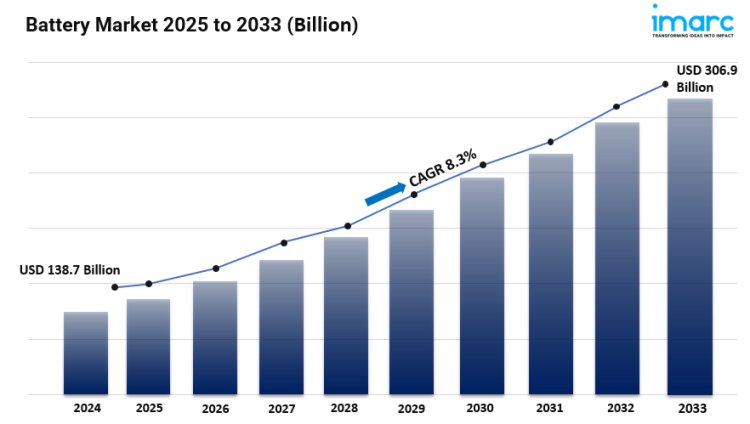

Battery Market 2025: Size, Share, Global Industry Overview, Opportunity and Forecast to 2033

The battery market is expected to reach USD 306.9 billion by 2033, exhibiting a growth rate (CAGR) of 8.3% during 2025-2033.

Share this Post to earn Money ( Upto ₹100 per 1000 Views )

IMARC Group, a leading market research company, has recently releases report titled “Battery Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033,” The study provides a detailed analysis of the industry, including the global battery market trends, size, share, growth and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the battery market?

The global battery market size reached USD 138.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 306.9 Billion by 2033, exhibiting a growth rate (CAGR) of 8.3% during 2025-2033.

Factors Affecting the Growth of the Battery Industry:

- Surging Demand for Lithium-Ion Batteries:

The global battery market is seeing a huge rise in demand. This growth is mainly due to the widespread use of lithium-ion (Li-ion) batteries in many industries. Electric vehicles (EVs) lead this demand as governments enforce strict carbon emission rules and promote eco-friendly transport. Market forecasts predict that global EV sales will skyrocket, increasing the need for powerful and energy-efficient batteries. The demand for Li-ion batteries goes beyond cars. Consumer electronics, renewable energy storage, and industrial uses are also driving this rapid market growth. The rise of smartphones, laptops, and IoT (Internet of Things) devices has created a greater need for batteries that last longer and charge faster. Moreover, energy storage for solar and wind projects is essential as countries work to stabilize their energy grids and shift to renewable sources. This ongoing demand is boosting investments in battery manufacturing, mining essential materials like lithium, cobalt, and nickel, and improving battery recycling technologies. Thus, the Li-ion battery market is set for major growth. Global production capacity is expected to increase significantly over the next decade.

- Supply Chain Constraints and Raw Material Shortages:

The battery market faces strong demand, but supply chain issues and raw material shortages are major challenges for manufacturers. Li-ion batteries depend on key minerals like lithium, cobalt, and nickel. These materials come from a few areas, mainly Australia, the Democratic Republic of Congo, and Indonesia. Rising geopolitical tensions, trade restrictions, and resource nationalism make access to these raw materials harder and more expensive. At the same time, increasing demand for batteries leads to supply constraints, causing price fluctuations and possible production delays. The COVID-19 pandemic further highlighted weaknesses in global supply chains, leading to delays in mining, refining, and battery production. To address these risks, battery manufacturers and automakers are looking for alternatives. They are building local supply chains and forming direct partnerships with mining firms. They are also exploring battery types that use fewer scarce materials. For example, lithium iron phosphate (LFP) batteries are gaining popularity because they don’t need cobalt or nickel. These batteries are cheaper and more stable. Companies are working harder to recycle old batteries and recover valuable materials. This reduces their reliance on newly mined resources.

- Technological Advancements and Next-Generation Batteries:

As battery demand grows, advancements in technology are shaping the market’s future. Researchers and companies are creating next-generation batteries with higher energy density, faster charging, longer lifespans, and better safety. Solid-state batteries, for example, are becoming a game-changer. They replace the liquid electrolyte in traditional Li-ion batteries with a solid one. This change boosts energy storage and lowers the risk of overheating or fire. If they succeed in commercialization, solid-state batteries could transform electric vehicles, offering longer ranges and faster charging. Sodium-ion batteries are also rising as an alternative to Li-ion tech. They provide cost benefits and use more abundant raw materials. Since sodium is easier to find than lithium, these batteries may ease resource scarcity. Other innovations like silicon-anode batteries, graphene-enhanced batteries, and bio-based storage solutions are being examined for better performance and sustainability.

Request for a sample copy of this report: https://www.imarcgroup.com/battery-market/requestsample

Battery Market Report Segmentation:

Breakup by Type:

- Primary Battery

- Secondary Battery

Breakup by Product:

- Lithium-Ion

- Lead Acid

- Nickel Metal Hydride

- Nickel Cadmium

- Others

Breakup by Application:

- Automotive Batteries

- Industrial Batteries

- Portable Batteries

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Global Battery Market Trends:

The global battery market is changing fast. This change is due to new technologies, rising energy storage needs, and more electric vehicles (EVs). Batteries are vital for today’s energy systems. They power gadgets, store renewable energy, and electrify transport. Recently, the market has grown rapidly. Lithium-ion (Li-ion) batteries have become the top choice because they are efficient, last long, and cost less to make. As industries and governments focus on sustainability, the need for effective and eco-friendly battery solutions is increasing. This shift is driving new ideas in battery chemistry, supply chain, and recycling, shaping the future of the battery industry. A major trend in the battery market is the rising demand for lithium-ion batteries, especially in electric vehicles (EVs). Governments around the world are enforcing strict emissions rules. They are phasing out internal combustion engine (ICE) vehicles and encouraging EV adoption through subsidies and infrastructure improvements. In response, automakers are increasing their EV production, which boosts the need for high-performance batteries. Companies like Tesla, BYD, and CATL are investing billions to expand battery production capacity to meet this demand.

Who are the key players operating in the industry?

The report covers the major market players including:

- A123 Systems LLC

- BYD Motors Inc.

- Contemporary Amperex Technology Co. Ltd.

- Envision AESC Group Ltd.

- GS Yuasa International Ltd.

- Johnson Controls

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Saft (Total Energies SE)

- Samsung SDI Co. Ltd.

- Tesla Inc.

- Toshiba Corporation

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=5369&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

MattWatson27

MattWatson27